Navigating Your Chase 1098: Mortgage Interest & Tax Season Clarity

As tax season approaches, understanding your financial documents is paramount, especially when it comes to something as crucial as your mortgage. For many homeowners, the annual arrival of the Chase 1098 form marks a significant step in preparing their tax returns, providing essential details about the interest paid on their home loan.

This form, officially known as the Mortgage Interest Statement, is vital for claiming deductions and ensuring accurate reporting to the IRS. Whether you're a long-time Chase customer or have recently had your loan serviced by them, deciphering this document can sometimes feel complex. This comprehensive guide aims to demystify the Chase 1098, helping you understand its components, how to access it, and what it means for your tax obligations. We'll explore everything from what Box 1 and Box 2 signify to how loan transfers impact your statements, ensuring you're well-equipped for a smooth tax filing experience.

Table of Contents

- Understanding the IRS Form 1098: Your Mortgage Interest Statement

- Decoding Your Chase 1098: Key Boxes Explained

- Accessing Your Chase Tax Documents Online

- Navigating Loan Transfers and Your 1098 Statement

- Beyond the 1098: Other Chase Financial Services

- Common Questions About Your Chase 1098

- Important Considerations and Disclaimers

- Preparing for Tax Season with Your Chase 1098

Understanding the IRS Form 1098: Your Mortgage Interest Statement

At the core of mortgage-related tax deductions for homeowners lies IRS Form 1098, the Mortgage Interest Statement. This critical document serves as an official record of the interest and related expenses you've paid on your home loan throughout the tax year. Understanding its purpose is the first step toward accurately filing your taxes and potentially maximizing your deductions.

IRS Form 1098 (Mortgage Interest Statement) reports interest on mortgage and home equity accounts. This means if you have a traditional mortgage or a Home Equity Line of Credit (HELOC) with Chase, you will likely receive this form, provided you meet the reporting thresholds. Specifically, a mortgage lender is required to report annually the interest paid on a qualified mortgage on IRS Form 1098 (Mortgage Interest Statement) when the interest received from an individual amounts to $600 or more. This threshold ensures that significant interest payments are properly documented for both the taxpayer and the IRS.

The form itself provides crucial information about Form 1098, Mortgage Interest Statement, including recent updates, related forms, and instructions on how to file. This comprehensive approach ensures that both lenders and borrowers have the necessary guidance to comply with tax regulations. For homeowners, the Chase 1098 is more than just a piece of paper; it's a key component of their tax preparation toolkit, detailing the deductible interest that can significantly reduce their taxable income.

Decoding Your Chase 1098: Key Boxes Explained

When you receive your Chase 1098, it can look like a simple form, but each box holds specific information vital for your tax return. Let's break down the most important sections you'll find on your Chase 1098.

Box 1: The Heart of Your Deduction

Box 1 is arguably the most important section on your Chase 1098. This box clearly states the total amount of mortgage interest you paid during the tax year. Box 1 shows the mortgage interest received during the tax year being reported (e.g., 2024). This figure is directly relevant for claiming the mortgage interest deduction on Schedule A (Form 1040), Itemized Deductions. For many homeowners, this deduction can be substantial, making accurate reporting of this figure crucial.

It's important to remember that when you receive a Form 1098, you should total the amounts listed in Box 1 plus any deductible points listed in Box 6. This combined figure represents the total amount of interest and points you may be able to deduct, subject to IRS limitations and rules.

Box 2: Principal Balance Insights

While not directly used for tax deductions, Box 2 provides valuable information about the status of your loan. Box 2 on IRS Form 1098 displays the principal balance of your loan as of January 1, 2024, or when Chase acquired or originated the loan in 2024. This figure gives you a snapshot of your loan's outstanding principal at the beginning of the tax year or at the point Chase began servicing your loan. It's particularly useful for tracking your loan's progress and understanding your financial position.

For Home Equity Line of Credit (HELOC) accounts, the information in Box 2 can differ slightly. For HELOC accounts originated in 2024, the amount reported in Box 2 will be the amount of the first draw you take. This distinction is important for HELOC holders to understand how their initial borrowing activity is reflected on the form.

Box 6: Points Paid on Your Loan

Box 6 on your Chase 1098 reports any "points" paid on the loan. Points are essentially prepaid interest that you might have paid at the time of your loan's origination or refinancing. These can often be deductible over the life of the loan or, in some cases, in the year they were paid, depending on IRS rules.

The IRS, in its Publication 936, clarifies that Form 1098 will, as a general rule, include points paid on the loan. However, the deductibility of these points can be complex and depends on various factors, such as whether the loan was for your main home, if the points were paid solely for the use of money, and if they were paid as a percentage of the amount borrowed. Always consult IRS Publication 936 or a tax professional for specific guidance on deducting points.

Accessing Your Chase Tax Documents Online

In today's digital age, Chase has made it incredibly convenient for customers to access their tax documents, including the Chase 1098, online. This streamlined process saves time and ensures you have immediate access to the information you need for tax preparation.

Learn how to access your HELOC tax documents on Chase.com. The process is generally similar for all mortgage accounts. Chase online banking has transformed the banking experience so you can bank your way, providing secure and convenient access to your financial information. You can typically log in to your Chase online account, navigate to the "Statements & Documents" or "Tax Documents" section, and download your 1098 form.

Chase understands the importance of timely access to tax information. They provide you with tax documents, statements, and important information to help you prepare for tax season. The information available online lets you know when you can expect to receive required tax forms for your J.P. Morgan Wealth Management investment accounts and Chase deposit and mortgage accounts, as well as other important information you may need to prepare your tax returns. This proactive communication helps you plan your tax filing schedule effectively. Furthermore, the date you can see your loan and make a payment on Chase.com is typically well in advance of tax season, allowing you to review your mortgage details throughout the year.

To get started with convenient and secure banking now, simply visit Chase.com and log in or register for online access. This digital accessibility is a testament to Chase's commitment to modern banking solutions.

Navigating Loan Transfers and Your 1098 Statement

It's not uncommon for mortgage loans to be transferred from one servicer to another during the life of the loan. This can sometimes lead to questions about how such a transfer will affect your IRS Form 1098 tax statements. The good news is that the process is designed to ensure you receive all necessary documentation, even if it comes from multiple sources.

If your mortgage loan is transferred, you won't miss out on any of your interest payment information. Your original servicer (e.g., Chase) will send you a 1098 form covering the period they serviced your loan. Subsequently, your new servicer will send your tax statement for the remainder of the year. This means you might receive two or more 1098 forms for the same tax year if your loan was transferred multiple times.

Each statement will reflect your taxes and mortgage interest paid during the specific time period in which each loan provider serviced your loan. When you prepare your taxes, you'll need to combine the information from all 1098 forms you receive for that tax year to get a complete picture of your total mortgage interest paid. It's crucial to keep all these documents organized to ensure accurate reporting to the IRS and to claim the full deduction you're entitled to.

Beyond the 1098: Other Chase Financial Services

While our primary focus is on the Chase 1098 and mortgage interest, it's worth noting that Chase offers a vast array of financial products and services that cater to diverse needs. Understanding the broader scope of Chase's offerings can provide context to their role as a comprehensive financial institution.

Chase provides a wide range of services, including credit cards, mortgages, commercial banking, auto loans, investing & retirement planning, checking, and business banking. This extensive portfolio means that many individuals and businesses interact with Chase for various financial requirements beyond just their home loan. For instance, customers might also receive tax documents related to their investment accounts from J.P. Morgan Wealth Management, which is part of the same corporate family as Chase.

Furthermore, Chase also extends its services into the insurance sector. Insurance products are made available through Chase Insurance Agency, Inc. (CIA), a licensed insurance agency, doing business as Chase Insurance Agency Services, Inc. This broad reach underscores Chase's position as a major player in the financial industry, offering integrated solutions to its clientele. It's also important to note that certain custody and other services are provided by JPMorgan Chase Bank, N.A., highlighting the diverse legal entities and specialized functions within the larger JPMorgan Chase & Co. framework.

Common Questions About Your Chase 1098

Even with detailed explanations, some common questions often arise regarding the Chase 1098 and its implications for tax filing. Addressing these can help clarify lingering doubts.

"Where do I find the interest I paid last year?" This is a frequent question, and the answer is straightforward: the total mortgage interest you paid last year is prominently displayed in Box 1 of your IRS Form 1098. This is the figure you'll primarily use for your tax deductions.

Another common query revolves around understanding if the interest is deductible. While the Chase 1098 provides the figures, the ultimate deductibility depends on IRS rules and your individual tax situation. You should use your Chase tax statements to discover if your mortgage interest is deductible and to reconcile your own payment records with the amounts reported by Chase. Generally, mortgage interest on a primary residence or a second home is deductible, up to certain limits, on loans used to buy, build, or substantially improve the home. However, interest on home equity loans or lines of credit used for other purposes may not be deductible. Always refer to IRS Publication 936 or consult a qualified tax professional for personalized advice.

Important Considerations and Disclaimers

Navigating tax documents like the Chase 1098 requires diligence and an understanding of key considerations. While this article provides general guidance, it's crucial to remember that tax laws are complex and subject to change.

- Accuracy is Key: Always double-check the figures on your Chase 1098 against your own payment records. If you find discrepancies, contact Chase customer service promptly to resolve them.

- Consult a Professional: This article is for informational purposes only and should not be considered tax advice. Tax laws are intricate, and your personal financial situation is unique. It is always recommended to consult with a qualified tax professional or financial advisor to ensure accurate tax filing and to understand the full implications of your Chase 1098 and other financial documents. They can provide personalized advice based on your specific circumstances.

- IRS Resources: The Internal Revenue Service (IRS) provides extensive resources, including publications like Publication 936 (Home Mortgage Interest Deduction), which offers detailed guidance on mortgage interest deductibility. These resources are invaluable for homeowners seeking to understand their tax obligations and potential deductions.

Preparing for Tax Season with Your Chase 1098

With your Chase 1098 in hand and a clearer understanding of its components, you're well on your way to a smoother tax season. Effective preparation can alleviate stress and ensure you file accurately and on time.

Here’s a checklist to help you prepare:

- Gather All Documents: Collect your Chase 1098 along with all other necessary tax forms (W-2s, 1099s, etc.).

- Review and Reconcile: Compare the information on your Chase 1098 with your personal records of mortgage payments. Ensure that the interest reported in Box 1 and any points in Box 6 align with your calculations.

- Understand Deductibility: Familiarize yourself with IRS rules regarding mortgage interest deductions. If you have questions about what you can deduct, especially concerning home equity loans or points, seek professional advice.

- Plan Your Filing: Decide whether you will use tax software, hire a tax preparer, or file manually. Having all your documents organized will make this process much more efficient.

- Stay Informed: Keep an eye on any updates to tax laws that might affect mortgage interest deductions for the current tax year.

By taking these proactive steps, your Chase 1098 will become a helpful tool rather than a source of confusion, enabling you to confidently navigate your tax obligations. Remember, accurate and timely filing is key to financial peace of mind.

Conclusion

The Chase 1098 form is an indispensable document for homeowners during tax season, detailing the crucial mortgage interest information needed for potential deductions. We've explored how this form, specifically the data in Box 1 and Box 2, provides a clear picture of your annual interest payments and loan principal. Understanding how to access your Chase 1098 online and what to do in case of loan transfers empowers you to manage your tax preparation effectively.

While the Chase 1098 simplifies reporting, the nuances of tax law require careful attention. Always cross-reference your statements, leverage Chase's convenient online banking tools, and don't hesitate to consult with a qualified tax professional for personalized advice. By taking these steps, you ensure accuracy and maximize your financial well-being. For more insights into managing your finances and understanding key tax

Education Credits and Deductions (Form 1098-T) – Support

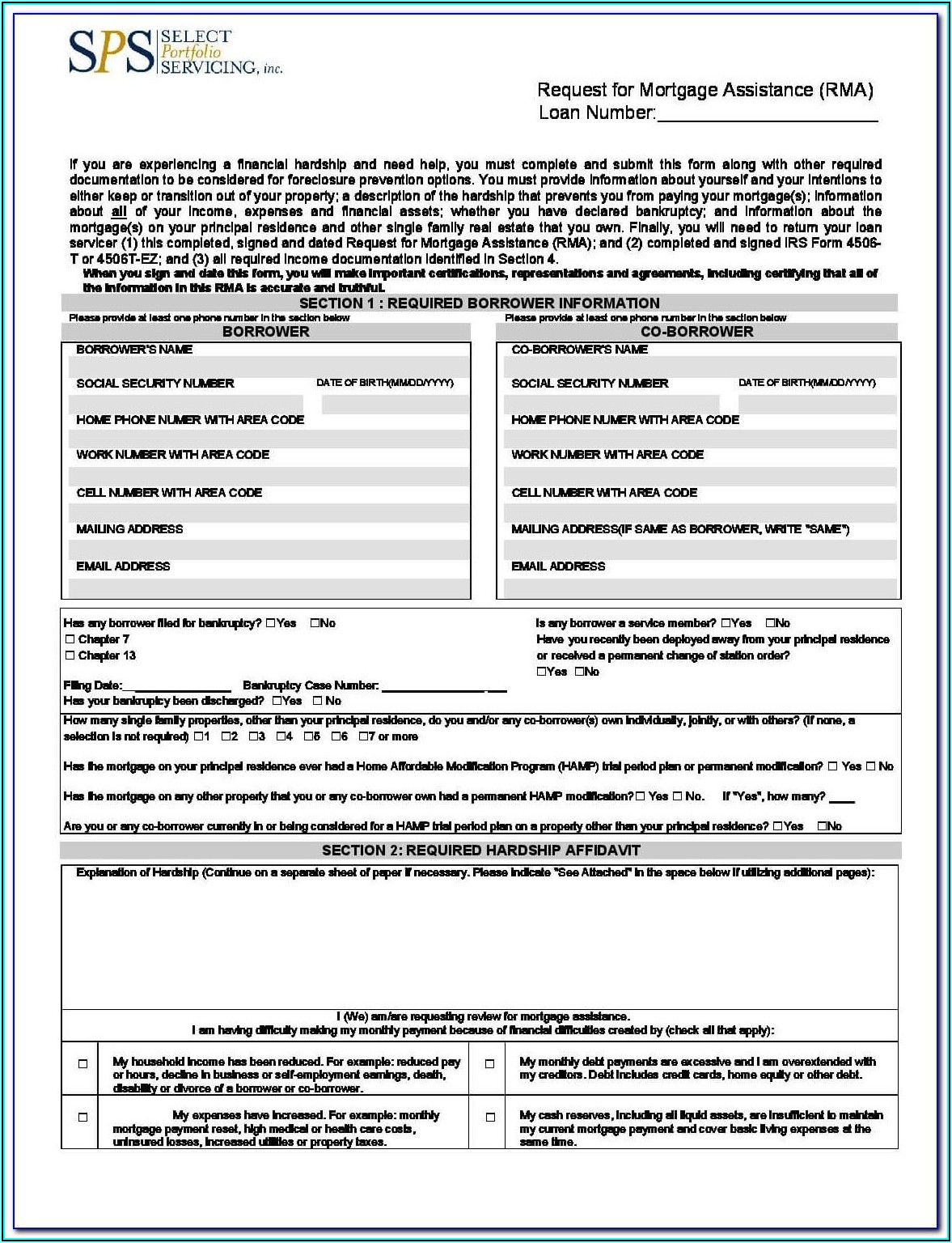

1098 Mortgage Interest Forms - Form : Resume Examples #QJ9el1wE2m

/ScreenShot2020-02-03at1.57.10PM-ab1915c984414b79910a4cbaf41b8003.png)

PRORFETY: How To Find Property Id Number On 1098