Dinar News Update: Navigating The Iraqi Dinar's Volatile Journey

For anyone tracking global currency markets, the Iraqi Dinar (IQD) often stands out as a subject of intense speculation and frequent "dinar news update" discussions. Its journey over the past two decades has been anything but stable, marked by significant fluctuations, political interventions, and the hopes and anxieties of a dedicated community of investors. Understanding the dynamics at play requires a deep dive into its history, the role of key institutions, and the influence of both official policy and unofficial commentary. This article aims to provide a comprehensive overview, drawing on various insights and reports to help you navigate the complex world of the Iraqi Dinar, ensuring you are well-informed and prepared for potential developments in this unique currency market.

From the official pronouncements of the Central Bank of Iraq (CBI) to the daily updates from online "dinar gurus," the narrative surrounding the IQD is multifaceted. Whether you're an investor, simply curious about the currency's future, or seeking to stay updated with the latest news and trends, comprehending these various streams of information is crucial. We'll explore the factors driving its value, the impact of international relations, and the vital role of community platforms in shaping perceptions and sharing intelligence regarding the Iraqi Dinar.

Table of Contents

- The Iraqi Dinar's Volatile History: A Two-Decade Overview

- Central Bank of Iraq (CBI) and Official Devaluation

- The Parallel Market and US Sanctions' Ripple Effect

- The Role of "Dinar Gurus" and Online Communities

- Dinar Chronicles: A Hub for RV/GCR Discussions

- Navigating the Dinar Information Landscape: Dinar Detectives, Dinar Times, and Dinar Opinions

- Taxation on Dinar Holdings: What You Need to Know

- Donald Trump, Currency Manipulation, and the IQD

The Iraqi Dinar's Volatile History: A Two-Decade Overview

The story of the Iraqi Dinar's exchange rate is one of dramatic shifts, reflecting the tumultuous history of Iraq itself. Over the past two decades, the IQD has experienced significant fluctuations against the US dollar on the parallel market. This volatility is not random but driven by a complex interplay of seasonal, political, and macroeconomic factors. A report by the Future Iraq Institute for Economic Studies and Consultations reportedly highlights these substantial shifts, underscoring the unpredictable nature of the currency for both local citizens and international observers.

Understanding this historical context is paramount for anyone seeking the latest dinar news update. The Iraqi economy, heavily reliant on oil revenues, is particularly susceptible to global oil price movements. When oil prices are low, the government's ability to cover expenses is severely strained, often leading to measures that impact the currency's value. Conversely, periods of political stability and higher oil prices can offer glimpses of potential strengthening, though these are often short-lived in a region prone to geopolitical tensions.

Understanding Exchange Rate Fluctuations

Exchange rate fluctuations in Iraq are not just about supply and demand; they are deeply intertwined with the nation's political stability and economic reforms. Seasonal factors, such as increased demand for foreign currency during pilgrimage seasons or for imports, can cause temporary shifts. However, more profound movements are often linked to political developments, such as government formation, budget approvals, or security challenges. Macroeconomic factors, including inflation, interest rates, and the Central Bank's monetary policy, also play a critical role in shaping the IQD's value.

For instance, the parallel market, where most everyday transactions occur, often reacts more swiftly and dramatically to these factors than the official rate. This disparity creates opportunities for arbitrage but also significant risks. Keeping an eye on reports from reputable economic institutes, alongside official statements, is essential for a balanced view of the Iraqi Dinar's true standing.

The Impact of Geopolitical and Economic Factors

Iraq's geopolitical position means that regional conflicts and international relations significantly influence its currency. Sanctions, trade agreements, and even the broader global economic climate can have direct or indirect effects on the IQD. For example, measures taken by the U.S. government regarding Iraqi banks can immediately send ripples through the parallel market, affecting the daily lives of Iraqis and the valuations of investors' holdings. This constant interplay of local and international forces makes the Iraqi Dinar a unique and challenging currency to track.

Central Bank of Iraq (CBI) and Official Devaluation

The Central Bank of Iraq (CBI) is the primary authority managing the nation's monetary policy, including the Iraqi Dinar's official exchange rate. Iraq Business News consistently brings the latest news from the CBI, providing crucial updates on its decisions, which often have profound impacts on the economy. One of the most significant actions taken by the CBI in recent years was the devaluation of the Iraqi Dinar.

In a move that sparked public outrage, Iraq's central bank on a Saturday announced it would devalue the Iraqi Dinar by over 20 percent. This drastic measure was a direct response to a severe liquidity crisis, primarily brought on by low oil prices. With oil revenues forming the backbone of the national budget, a significant drop in prices meant the government struggled immensely to cover its expenses, leading to a critical shortage of funds. The devaluation aimed to boost government revenues in dinars and stabilize the economy, albeit at the cost of reduced purchasing power for ordinary citizens.

Responding to Liquidity Crises

The decision to devalue was a desperate attempt to shore up the national budget and address the liquidity crunch. By making imports more expensive and exports (primarily oil) cheaper in foreign currency terms, the CBI hoped to improve the balance of payments and increase the dinar value of oil sales. However, such measures often come with significant social and economic consequences, including inflation and a decrease in the real income of the populace, leading to public discontent.

For those following the Iraqi Dinar revaluation and investment news, understanding the CBI's role and its responses to economic pressures is fundamental. Subscribe for regular CBI Iraq updates to stay informed about official policy changes, as these are critical indicators of the currency's future direction.

The Parallel Market and US Sanctions' Ripple Effect

While the CBI sets an official exchange rate, the parallel market often tells a different story, reflecting real-time supply and demand pressures, as well as external influences. The relationship between the official rate and the parallel market rate is a constant point of discussion and speculation within the dinar community. Some, like Iraqi Dinar intel guru Frank26, and even reports from "Iraq's troops on the ground" via sources like Frirefly and Mr. Sammy, have claimed that the official CBI rate and the parallel market pricing would soon be equal. This expectation of convergence is a key driver for many investors.

However, recent events have shown the parallel market's susceptibility to external shocks. Over two days, the market rate of the dollar jumped significantly, from 1,470 dinar per dollar to 1,570 dinar per dollar. This sharp increase was not arbitrary but followed a specific action by the U.S. government.

The Jump in Dollar Rates and Money Laundering Concerns

The jump in the parallel market rate came after the U.S. listed 14 private Iraqi banks among those banned from dealing with U.S. dollars. The reason cited for this ban was suspicions of money laundering and funneling funds to Iran. This action immediately tightened the supply of dollars in the Iraqi market, pushing up the value of the dollar against the dinar on the parallel market. Such sanctions highlight the interconnectedness of international finance and the profound impact geopolitical decisions can have on local currency markets, directly affecting the daily dinar news update for millions.

This incident underscores the inherent risks in the Iraqi Dinar market, particularly for those who rely on the parallel rate for their investments. While the official rate might remain stable for periods, the parallel market can react swiftly and dramatically to external pressures, making it a volatile environment for investors.

The Role of "Dinar Gurus" and Online Communities

In the absence of clear, consistent official information, a unique ecosystem of "dinar gurus" and online communities has emerged, becoming central to the dinar news update landscape. These individuals and platforms serve as primary sources of "intel," opinions, and analyses for a dedicated following of investors. Websites like Dinar Detectives, Dinar Times, and Dinar Opinions offer daily updates, recaps, and analyses, drawing on information from various sources, including these self-proclaimed gurus.

These platforms often feature discussions around the latest news, rumors, and investor sentiments, shaping the narrative around the currency's potential future. Dinar Opinions, for instance, is a platform dedicated to providing "dinar guru updates, latest Iraq news, and intel related to the Iraqi Dinar (IQD)." Similarly, Dinar Detectives provides "daily dinar updates and dinar recaps, featuring insights from popular dinar gurus." While these sources offer valuable insights into community sentiment and speculative theories, it's crucial for investors to exercise extreme caution and verify information from official, reputable channels whenever possible. The information shared is often based on interpretations, rumors, or unverified "intel," and should not be taken as financial advice.

One prominent figure often mentioned is "Pimpy." The question "Does Pimpy hold dinar?" is often asked within the community, with the answer being "yes, Pimpy has 5 million dinars." This kind of anecdotal information, while not indicative of market trends, illustrates the personal connection and shared interest within the dinar community. The community thrives on shared hope and the collective interpretation of various pieces of information, whether official or speculative.

Dinar Chronicles: A Hub for RV/GCR Discussions

Among the various online platforms, Dinar Chronicles stands out as a significant hub for the Iraqi Dinar community, particularly for those interested in the "RV/GCR" (Revaluation/Global Currency Reset) theories. Founded in February 2014 by Patrick Dacosta (Terrazetzz), Dinar Chronicles' main goal is to share all news and predictions about the global currency reset from all perspectives, without bias. Over time, the website also became a voice for the RV/GCR community, fostering discussions and sharing updates that fuel the hopes of many investors.

The concept of an "RV" (Revaluation) suggests a significant increase in the Iraqi Dinar's value against major currencies, while "GCR" (Global Currency Reset) refers to a broader, hypothetical restructuring of the world's financial system that would see various currencies revalued. These theories are highly speculative and have been the subject of intense debate and anticipation for years. Dinar Chronicles provides a platform for these discussions, aggregating news, opinions, and "intel" from various sources, including the aforementioned dinar gurus. Staying informed with comprehensive coverage of the latest Dinar Chronicles and gaining valuable insights from dinar guru opinions is a common practice for those deeply immersed in this speculative market.

Navigating the Dinar Information Landscape: Dinar Detectives, Dinar Times, and Dinar Opinions

For anyone seeking a daily dinar news update, the online landscape offers a plethora of resources, each with its own focus and style. Websites like Dinar Detectives, Dinar Times, and Dinar Opinions are key players in this space. They provide daily updates, recaps, and analyses, drawing on information from various sources, including the insights from popular dinar gurus. These platforms are crucial for shaping the narrative around the currency's potential future, featuring discussions around the latest news, rumors, and investor sentiments.

Welcome to latest Iraqi Dinar updates, as many of these sites would proclaim. They cover everything from currency exchange rates, market forecasts, and the elusive RV. While these sites offer a wealth of information and a sense of community, it's vital for readers to approach them with a critical eye. The line between verified news, expert opinion, and pure speculation can often be blurred. Therefore, cross-referencing information with official sources like the Central Bank of Iraq and reputable financial news outlets is always recommended.

Taxation on Dinar Holdings: What You Need to Know

A crucial aspect often overlooked by prospective investors in the Iraqi Dinar, or any foreign currency, is the tax implication of potential gains. The question "Are we going to pay taxes on our dinar?" is met with a definitive "of course you are." Any profit realized from the sale of foreign currency, including the Iraqi Dinar, is generally considered a taxable event in most jurisdictions. This typically falls under capital gains tax, though the specifics can vary depending on the investor's country of residence and the duration for which the currency was held.

It is imperative for individuals holding Iraqi Dinar to understand their tax obligations. This involves keeping meticulous records of purchase prices, dates, and any transaction fees. When and if a revaluation or significant appreciation occurs, the difference between the purchase price and the sale price (or the value at which it's converted back to your local currency) will likely be subject to taxation. Consulting with a qualified tax professional is highly recommended to understand the specific tax laws applicable to your situation and to ensure compliance, as tax regulations can be complex and are subject to change.

Donald Trump, Currency Manipulation, and the IQD

The topic of currency manipulation has periodically entered the global discourse, particularly during the administration of Donald Trump. According to Iraqi Dinar intel guru Frank26, Donald Trump forbids currency manipulation, which he was actively dealing with. This perspective suggests that Iraq's actions regarding its currency could fall under such scrutiny. The notion that "Iraq is manipulating its currency" has been a point of discussion among those following the IQD, especially in the context of its devaluations and the disparity between official and parallel market rates.

The question then arises: "Which nation, in your opinion, should he target first with this currency manipulation?" While this specific query is speculative and rhetorical, it highlights the broader concern within the dinar community about international pressure on Iraq's currency policies. Any perceived manipulation, whether by the CBI or through unofficial channels, could potentially invite international attention or even sanctions, further complicating the IQD's trajectory. This adds another layer of political risk to an already volatile currency, emphasizing the need for investors to stay abreast of geopolitical developments that could influence the Iraqi Dinar's standing on the global stage.

Conclusion

The journey of the Iraqi Dinar is a compelling narrative of economic challenges, political shifts, and fervent speculation. From the significant fluctuations reported by the Future Iraq Institute for Economic Studies and Consultations to the direct impact of U.S. sanctions on the parallel market, the IQD remains a currency of intense interest. The Central Bank of Iraq's decisions, such as the recent devaluation, underscore the government's struggle with liquidity crises, while the vibrant online communities, led by "dinar gurus" and platforms like Dinar Chronicles, continue to fuel hopes of a revaluation or global currency reset.

As we've explored, understanding the nuances of the Iraqi Dinar requires a blend of official news, market observations, and a critical approach to community-driven intel. The question of taxation on potential gains is a practical reality that every investor must consider, and the broader geopolitical context, including discussions around currency manipulation, adds layers of complexity. For the latest updates, follow our ongoing coverage and remember, in the world of finance, preparation is your greatest asset—don’t miss this opportunity, but proceed with caution. Whether you're an investor, curious about the currency, or just seeking to stay updated with the latest dinar news update and trends, continuous research and a balanced perspective are your best allies. We encourage you to share your thoughts in the comments below or explore other related articles on our site for more insights into global currency markets.

Iraqi Dinar News & Updates | Dinar Exchange Blogs

Iraqi Dinar News & Updates | Dinar Exchange Blogs

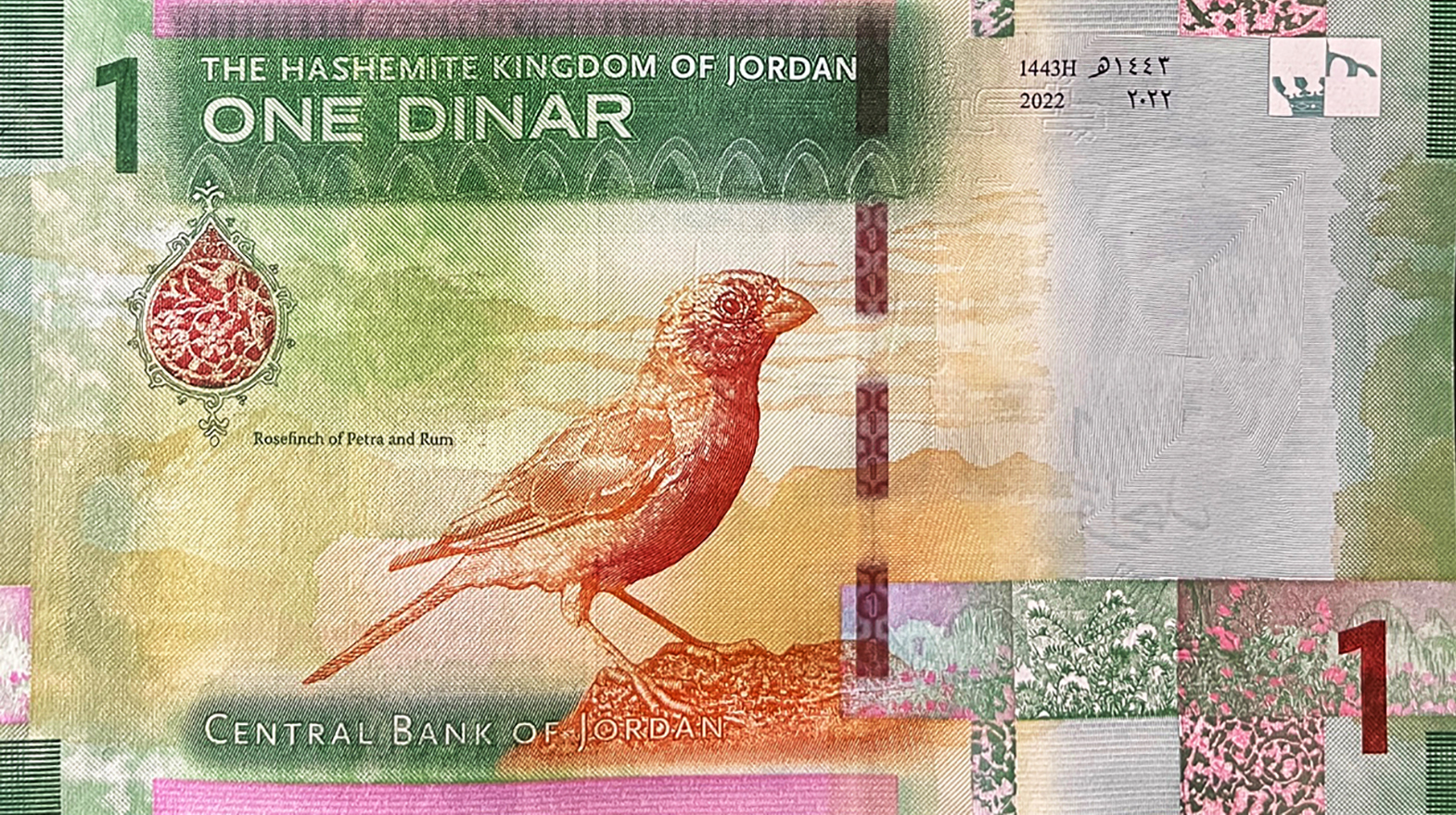

Jordan new 1-dinar note (B235a) confirmed – BanknoteNews