Navigating The Texas TABC License: Your Complete Guide

Understanding the Texas Alcoholic Beverage Commission (TABC)

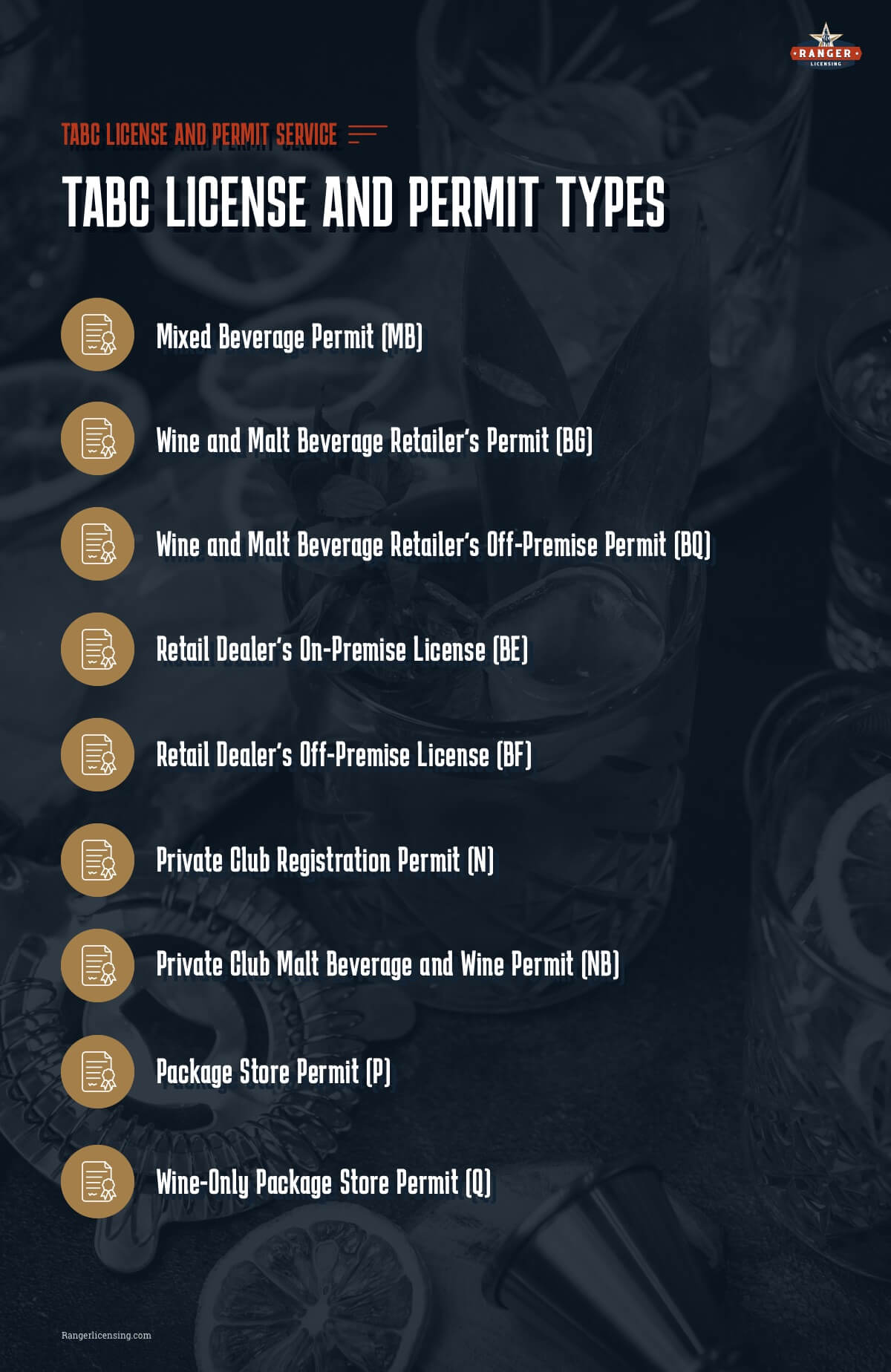

Types of TABC Licenses and Permits

Retail Licenses: Bars, Restaurants, and Stores

Manufacturing and Distribution Licenses: Breweries, Wineries, and Distilleries

Temporary Event Permits: Special Occasions and Festivals

The TABC License Application Process: A Step-by-Step Guide

Checking Your TABC License Application Status

Renewing Your TABC License: Deadlines and Penalties

TABC Certification: Beyond the License

Leveraging TABC's Online Systems: AIMS and RLPS

Ensuring Compliance and Avoiding Pitfalls

Conclusion

Operating a business that sells, manufactures, or distributes alcoholic beverages in Texas requires strict adherence to state regulations, with the cornerstone being a valid TABC license. This comprehensive guide will demystify the process of obtaining, managing, and renewing your Texas Alcoholic Beverage Commission (TABC) license, ensuring you navigate the complexities with confidence and compliance. Whether you're a budding entrepreneur looking to open a new bar, a seasoned restaurateur, or a large-scale distributor, understanding the nuances of TABC regulations is paramount for your business's success and legality.

The world of alcohol sales is highly regulated for good reason, aiming to ensure public safety, responsible consumption, and fair business practices. In Texas, the TABC stands as the primary authority, establishing a structured system that governs every aspect of alcohol sales and consumption across the state. From the initial application to ongoing compliance and renewal, every step is critical. This article provides essential guidance, resources, and answers to frequently asked questions, helping you understand license types, handle temporary events, and manage your operations smoothly.

Understanding the Texas Alcoholic Beverage Commission (TABC)

The Texas Alcoholic Beverage Commission (TABC) is the state agency responsible for regulating the alcoholic beverage industry within Texas. Its primary mission is to ensure public safety and lawful commerce related to alcohol. The TABC establishes a structured system governing alcohol sales and consumption across the state, setting the rules for everything from manufacturing to retail sales.

One crucial aspect of the TABC's regulatory framework is its allowance for local control. This means that different areas within Texas may have unique restrictions that go beyond state-level regulations. For instance, some counties or cities might be "dry" (prohibiting alcohol sales), "wet" (allowing full sales), or "partially wet" (allowing certain types of sales, like beer and wine but not liquor). Therefore, understanding both state TABC regulations and local ordinances is vital for any business seeking a TABC license.

The Texas Alcoholic Beverage Code categorizes businesses based on the type of alcohol they sell and how it is distributed. The TABC oversees these licenses, ranging from retail permits for bars and restaurants to manufacturing and distribution licenses for breweries, wineries, and distilleries. This categorization ensures that each segment of the industry operates under specific, tailored guidelines designed to maintain order and accountability.

Types of TABC Licenses and Permits

The TABC offers a wide array of licenses and permits, each designed to fit specific business models within the alcohol industry. Understanding the various types is the first critical step in securing your TABC license. These categories are primarily based on whether you're manufacturing, distributing, or selling alcoholic beverages, and the specific type of alcohol involved (beer, wine, or distilled spirits).

Retail Licenses: Bars, Restaurants, and Stores

For businesses that sell alcohol directly to consumers, such as bars, restaurants, grocery stores, and convenience stores, several retail licenses are available. The most common include:

- Mixed Beverage Permit (MB): Required for establishments that sell distilled spirits, beer, and wine for on-premise consumption (e.g., bars, full-service restaurants).

- Beer Retailer's On-Premise Permit (BE): Allows the sale of beer for consumption on the premises.

- Wine and Beer Retailer's Permit (BG): Permits the sale of beer and wine for on-premise consumption.

- Package Store Permit (P): For businesses selling distilled spirits and wine for off-premise consumption (e.g., liquor stores).

- Beer Retailer's Off-Premise Permit (BF): Allows the sale of beer for off-premise consumption (e.g., grocery stores, convenience stores).

- Wine Only Package Store Permit (Q): For businesses selling wine for off-premise consumption.

Each of these permits comes with specific requirements regarding the type of establishment, hours of sale, and often, the food service component if applicable.

Manufacturing and Distribution Licenses: Breweries, Wineries, and Distilleries

Businesses involved in the production or wholesale distribution of alcohol require different types of TABC licenses:

- Brewer's Permit (BW): For facilities that manufacture beer.

- Winery Permit (G): For operations that produce wine.

- Distiller's Permit (D): For businesses that manufacture distilled spirits.

- Wholesaler's Permit (W): Allows the sale of alcoholic beverages to retailers.

- Local Distributor's Permit (K): For distributors of beer.

These licenses often involve more stringent requirements, including detailed facility inspections, production capacity, and adherence to specific labeling and packaging regulations. Learn about the various licenses and permits offered by TABC for manufacturing, distributing, and selling alcoholic beverages in Texas. You'll need to find out the requirements, authorities, and application forms for each license or permit type relevant to your business.

Temporary Event Permits: Special Occasions and Festivals

For short-term events where alcohol will be sold or served, such as festivals, concerts, or private parties, TABC offers temporary permits. These are crucial for ensuring legal compliance for non-permanent operations. Examples include:

- Temporary Mixed Beverage Permit: For temporary events selling spirits, beer, and wine.

- Temporary Beer Permit: For temporary events selling beer.

- Temporary Wine Permit: For temporary events selling wine.

These permits typically have shorter application windows and specific rules regarding the duration of the event and the types of alcohol that can be sold. Get guidance, resources, and FAQs on license types, temporary events, disasters, and more from the TABC's official channels.

The TABC License Application Process: A Step-by-Step Guide

Applying for a TABC license can seem daunting, but by breaking it down into manageable steps, the process becomes clearer. The TABC has streamlined much of this through its online systems, but careful preparation is still key. By following these steps—understanding the license types, complying with zoning laws, completing the application process, and passing background checks and inspections—you can ensure a smooth path to legal alcohol sales.

- Understand Your Needs: As detailed above, identify the exact TABC license type that matches your business model. This is the foundational step.

- Comply with Zoning Laws: Before even applying, verify that your proposed business location complies with local zoning ordinances regarding alcohol sales. Remember, TABC allows for local control, meaning different areas may have unique restrictions.

- Gather Required Documents: This typically includes business entity formation documents, personal information for all owners/officers, financial statements, floor plans, and proof of legal occupancy for your premises.

- Complete the Application Form: The TABC primarily uses the Regulatory Licensing and Permitting System (RLPS) for applications. Beginning January 22, 2018, the agency successfully launched RLPS, allowing for efficient processing of licenses and permits. You'll need to use the information on the TABC website and linked documents as a required information reference when applying for or renewing a license or permit in RLPS. For existing businesses, the Alcohol Industry Management System (AIMS) is your online hub for conducting your Texas Alcoholic Beverage Commission business anytime and anywhere. Log in to apply for a license, manage your licenses, register products, file reports, and more.

- Background Checks: All applicants, including owners, partners, and corporate officers, will undergo thorough background checks.

- Inspections: Your premises will be inspected by TABC agents to ensure compliance with health, safety, and TABC-specific regulations. Agents of the Texas Alcoholic Beverage Commission (TABC), U.S. officials, and other law enforcement agencies work together to enforce these regulations.

- Pay Fees: There are various fees associated with each license type, including application fees and annual permit fees.

Find out how to apply for, renew, or check the status of TABC licenses and permits for the alcohol industry in Texas. The TABC website is your primary resource for forms and detailed instructions.

Checking Your TABC License Application Status

Once you've submitted your application, patience is key, but you can also actively monitor its progress. The TABC has made it convenient to check your TABC license application status online.

If you filed your license application through the Alcohol Industry Management System (AIMS), you can check the status by simply logging in to your AIMS account. AIMS provides a centralized platform for managing all your TABC-related business.

Additionally, the TABC offers a public inquiry system. You can use this system to find a license's status, create lists of licenses, see complaints, and get other information about TABC license holders. This transparency is beneficial for both applicants and the public.

Renewing Your TABC License: Deadlines and Penalties

Maintaining a valid TABC license is an ongoing responsibility. Licenses are not permanent and require regular renewal. The TABC has specific deadlines and penalties for late renewals that all license holders must be aware of.

Following the expiration of a license, the licensee may legally operate for an additional 60 days. This 60-day grace period is crucial, during which time the license may be renewed by paying the standard renewal fee and a 50% penalty. This penalty is a significant deterrent to late renewals, emphasizing the importance of timely action.

However, if the renewal fee and penalty fee have not been paid within these 60 days of the expiration of a license, the license is canceled. Once canceled, the licensee may no longer exercise the privileges of that license, meaning they cannot legally sell or serve alcohol. Failure to meet this deadline may result in a visit from TABC agents, an administrative warning, or even the suspension or permanent cancellation of the license or permit. This underscores the critical nature of adhering to renewal deadlines to avoid operational disruptions and legal repercussions. To renew these licenses or apply for a product registration, you can use the AIMS system, which is designed to streamline this process.

TABC Certification: Beyond the License

While a TABC license permits a business to sell alcohol, TABC certification (also known as a server permit or alcohol awareness training) is a separate but equally vital requirement for individuals who sell or serve alcoholic beverages. This certification isn't just a box to check; it's a program recognized by the Texas Alcoholic Beverage Commission that trains alcohol servers and sellers on responsible alcohol service.

The training covers crucial topics such as identifying intoxicated individuals, preventing underage drinking, and handling risky scenarios on the job. It equips individuals with the knowledge and skills to serve alcohol responsibly, thereby mitigating risks for both the establishment and the public.

Key requirements for TABC certification include:

- Applicants must be at least eighteen (18) years old.

- Applicants must complete a TABC certified alcohol awareness program within one (1) year of the server permit application date.

There are many approved providers for this training, including online platforms like "TABC on the Fly," which is an official provider of online TABC certification for sellers and servers of alcoholic beverages in Texas, approved by the Texas Alcoholic Beverage Commission. Often, you can find packages that combine TABC certification with national food handler certifications, with a mandatory $2.00 state filing fee typically added at checkout for the fastest ANAB + TABC package.

Once certified, agency staff and TABC license and permit holders can use a dedicated system to verify that a person's certification is current and valid. The information in this system is considered official proof of certification. It's important to note that expired TABC certifications cannot be renewed; if your certification lapses, you must retake the certification program. Use the certificate inquiry link on the TABC website to check the status or print proof of TABC certification.

Leveraging TABC's Online Systems: AIMS and RLPS

The TABC has invested significantly in digital platforms to streamline its processes, making it easier for businesses to interact with the agency. The two primary systems are the Regulatory Licensing and Permitting System (RLPS) and the Alcohol Industry Management System (AIMS).

RLPS, launched in January 2018, was designed to efficiently process new licenses and permits. It serves as the primary portal for initial applications. When applying for or renewing a license or permit in RLPS, it's crucial to use the information on the TABC website and linked documents as a required information reference. This ensures you provide all necessary details accurately, preventing delays.

AIMS, on the other hand, functions as your online hub for conducting your Texas Alcoholic Beverage Commission business anytime and anywhere. It's a comprehensive system that allows you to:

- Apply for a TABC license (for new applications, often integrated with RLPS).

- Manage your existing licenses and permits.

- Register products.

- File reports.

- Renew your licenses.

These systems are central to modern TABC operations, offering convenience and efficiency. They are designed to provide a seamless experience for license and permit holders, from initial application to ongoing compliance and renewal. By familiarizing yourself with AIMS and RLPS, you can significantly simplify your TABC-related administrative tasks.

Ensuring Compliance and Avoiding Pitfalls

Operating within the alcohol industry in Texas demands continuous vigilance and adherence to TABC regulations. Beyond merely obtaining a TABC license, ongoing compliance is crucial to avoid severe penalties that can jeopardize your business. The TABC's enforcement extends to various aspects, including responsible service, accurate record-keeping, and timely renewals.

One of the most common pitfalls is the failure to renew a license on time, as discussed earlier. The 60-day grace period with a 50% penalty is a clear warning, and exceeding this period leads to cancellation. Such a cancellation means immediate cessation of alcohol sales, which can be devastating for a business. The TABC is proactive in its enforcement, and failure to meet deadlines may result in a visit from TABC agents, an administrative warning, or even suspension or permanent cancellation of the license or permit.

Other areas of compliance include ensuring all staff who serve or sell alcohol have valid TABC certification. As noted, this certification is a legal requirement for individuals, and businesses can face penalties if their employees are found to be uncertified. Regular training refreshers and checking certification status through the official TABC inquiry system are best practices.

The TABC also conducts audits and investigations to ensure businesses are operating within the bounds of the Texas Alcoholic Beverage Code. This includes verifying product registration, proper excise tax payments, and adherence to all aspects of their specific TABC license. Staying informed about any changes to the code and maintaining meticulous records are vital for passing such checks. By diligently following all TABC guidelines, businesses can protect their investment and ensure long-term, legal operation in the Texas alcohol market.

Conclusion

Navigating the intricate landscape of TABC licenses and permits in Texas is a critical undertaking for anyone involved in the alcohol industry. From understanding the diverse types of TABC licenses available to meticulously following the application process, staying informed about renewal deadlines, and ensuring all staff possess valid TABC certification, every step is essential for legal and successful operation. The TABC's structured system, bolstered by efficient online platforms like AIMS and RLPS, aims to provide clarity and streamline processes, yet the onus remains on businesses to proactively meet their obligations.

By prioritizing compliance and leveraging the resources provided by the TABC, you can safeguard your business against penalties, maintain your operational integrity, and contribute to a responsible alcohol market in Texas. We hope this comprehensive guide has illuminated the path to securing and managing your TABC license effectively. Do you have further questions or insights from your own experience with TABC regulations? Share your thoughts in the comments below, or explore our other articles for more valuable business guidance.

TABC Texas Liquor License | Monshaugen & Van Huff, P.C.

TABC License and Permit Service | Texas Liquor License

TABC License and Permit Service | Texas Liquor License