Colorado Unemployment Taxes: A Comprehensive Guide For Employers & Claimants

Table of Contents

- Understanding Colorado Unemployment Taxes: The Basics

- The Mechanics of Employer Premiums in Colorado

- Who Benefits? Eligibility for Unemployment Insurance

- Navigating MyUI+: A Claimant's Guide

- The Critical Role of Reporting and Data Integrity

- Protecting the System: Combating SUTA Dumping

- Staying Compliant: Tips for Colorado Employers

- The Future of Colorado Unemployment Taxes

Understanding Colorado Unemployment Taxes: The Basics

At its core, the system of Colorado unemployment taxes, often referred to as unemployment insurance (UI) premiums, is a mandatory contribution from employers that creates a collective fund. This fund is then used to pay benefits to eligible individuals who find themselves temporarily out of work. It's not a direct tax on an individual's income, but rather a payroll tax levied on businesses. The foundational principle is straightforward: **unemployment insurance (UI) benefit payments are funded by the premiums paid by Colorado employers into the UI trust fund.** This trust fund acts as a reservoir, ensuring that funds are available when economic downturns or individual layoffs occur. Without these employer contributions, the safety net for unemployed workers would simply not exist. Most employers in Colorado are required to pay UI premiums if they meet specific criteria, typically related to their payroll size or the number of employees they have. This broad requirement ensures that the burden of funding the system is shared across the business community, reflecting the shared responsibility for supporting the workforce. The premiums are calculated based on a percentage of each employee's wages, up to a certain taxable wage base. This structure ensures a predictable revenue stream for the trust fund, allowing the Division of Unemployment Insurance (UI) to manage benefit payouts effectively. The system is designed to be self-sustaining, with employer contributions directly supporting those in need.The Mechanics of Employer Premiums in Colorado

Understanding how Colorado unemployment taxes are calculated and applied is paramount for any business operating within the state. These premiums are not static; they fluctuate based on a variety of factors, reflecting both the employer's individual history and the broader economic health of Colorado. The Division of Unemployment Insurance (UI) is the entity responsible for determining these rates annually, ensuring fairness and solvency.How Premium Rates Are Determined

The premium rates for Colorado unemployment taxes are not arbitrary. Instead, **the Division of Unemployment Insurance (UI) determines employer premium rates annually based on a number of factors, such as the amount of premiums paid by the employer and any benefits charged against their account.** This is often referred to as an "experience rating" system. Here's a breakdown of the key factors influencing an employer's UI premium rate: * **Benefit Charges:** When an employer's former employee receives unemployment benefits, those benefits are "charged" against the employer's account. A higher number of benefit charges typically leads to a higher premium rate. This incentivizes employers to maintain stable workforces and to challenge invalid claims. * **Premiums Paid:** The total amount of premiums an employer has paid into the system over a period. This contributes to their overall experience. * **Taxable Wage Base:** This is the maximum amount of an employee's wages that is subject to UI premiums in a given year. Wages earned above this threshold are not taxed for UI purposes. This amount can change annually. * **Trust Fund Balance:** The overall health and solvency of Colorado's UI Trust Fund also play a role. If the fund's balance is low, rates across the board might be adjusted to ensure it remains solvent. * **Industry Rate:** For new businesses, or in certain situations, the industry in which the business operates can influence the initial rate. This experience rating system is designed to be equitable, meaning employers with a history of fewer layoffs and lower benefit charges will generally pay lower premium rates, while those with more frequent layoffs will pay higher rates. This encourages stable employment practices across the state.New Business Introductory Rates

For a new business just starting out in Colorado, the question often arises: **What is the introductory UI premium rate for a new business in Colorado?** Unlike established businesses with an experience rating, new employers don't have a history of benefit charges or premiums paid. Therefore, **new employers begin at a rate based on the industry they support.** This introductory rate is typically a standard rate for new businesses within a specific industry sector, reflecting the average unemployment risk associated with that industry. This allows new businesses to contribute to the UI fund from the outset without being penalized for a lack of history. After a certain period (usually a few years), once the business has established an employment history, they will transition to an experience-rated premium rate, calculated based on their individual performance.The Solvency Surcharge

Beyond the standard experience-rated premium, there's another factor that can influence Colorado unemployment taxes: the solvency surcharge. **If the solvency surcharge is in effect, the surcharge is an additional percentage added to an employer's premium rate.** This surcharge is typically implemented when the UI Trust Fund's balance falls below a certain statutory threshold, indicating a need to replenish the fund to ensure its long-term stability and ability to pay benefits. It acts as a temporary measure to bolster the fund during periods of high unemployment or economic strain. Employers should always check their annual rate notices to see if a solvency surcharge is applicable to their premiums.Who Benefits? Eligibility for Unemployment Insurance

While employers are responsible for funding the system through Colorado unemployment taxes, the ultimate purpose of these contributions is to provide a safety net for workers. Understanding who is eligible for unemployment benefits is crucial for both employers (to manage their workforce and respond to claims) and individuals (to know if they can access support). Unemployment insurance (UI) benefits are designed for individuals who have lost their jobs through no fault of their own. This generally means they were laid off due to lack of work, downsizing, or a business closure, rather than being fired for misconduct or voluntarily quitting without good cause. A key piece of information for a specific segment of the workforce is that **if you are a federal employee who has been recently laid off, you may be eligible for unemployment benefits.** Federal employees, though not covered by state UI laws in the same way private sector employees are, typically have their unemployment benefits administered through state UI agencies, with the federal government reimbursing the state for those benefits. This ensures that a wide range of workers, including those in federal service, have access to this crucial support. Beyond the "no fault" requirement, eligibility also hinges on: * **Monetary Eligibility:** Applicants must have earned a certain amount of wages during a "base period" (a specific 12-month period prior to filing a claim). This ensures that only individuals with a recent work history are eligible. * **Availability for Work:** Claimants must be able to work, available for work, and actively seeking new employment. This means they must be ready and willing to accept suitable work if offered. * **Weekly Certification:** To continue receiving benefits, claimants must typically certify weekly that they meet ongoing eligibility requirements, including their job search efforts. The system is designed to provide temporary relief, encouraging claimants to actively seek new employment while receiving support.Navigating MyUI+: A Claimant's Guide

In Colorado, the primary online portal for managing unemployment benefits is MyUI+. This system is designed to streamline the process for claimants, from initial application to weekly benefit requests and managing account information. **MyUI+ is the unemployment benefits system for claimants,** serving as a central hub for all interactions with the Division of Unemployment Insurance. For many, especially those new to the system, navigating MyUI+ can seem complex. However, it's an essential tool for accessing benefits. **If you need help setting up your account in the new MyUI+ system, requesting weekly benefits, or help with a program integrity issue on your account, resources are available.** The Colorado Department of Labor and Employment (CDLE) provides various forms of assistance, including online FAQs, tutorials, and direct support lines. Here's what claimants typically use MyUI+ for: * **Filing an Initial Claim:** This is where the process begins, providing personal information, employment history, and reasons for separation. * **Requesting Weekly Benefits:** After an initial claim is approved, claimants must typically request benefits each week through MyUI+ to certify their eligibility and job search efforts. * **Checking Claim Status:** MyUI+ allows claimants to monitor the progress of their claim, see payment history, and view any outstanding issues. * **Managing Account Information:** Updating contact details, direct deposit information, and other personal data. * **Responding to Requests for Information:** The system is used by the UI division to communicate with claimants, including requests for additional documentation or clarification. * **Addressing Program Integrity Issues:** If there are questions about the validity of a claim, potential overpayments, or other compliance matters, MyUI+ is the platform for communication and resolution. Understanding how to effectively use MyUI+ is critical for anyone seeking or receiving unemployment benefits in Colorado. It's the gateway to financial support during a challenging time.The Critical Role of Reporting and Data Integrity

The smooth functioning of the Colorado unemployment taxes system relies heavily on accurate and timely reporting from employers. This isn't just a bureaucratic formality; it's fundamental to the integrity of the entire unemployment insurance program. **Information gathered from these reports is crucial to maintain the integrity of UI benefit payments, the accurate calculation of employer premium rates and federally mandated reports about the system.** Employers are required to submit quarterly wage reports, detailing the wages paid to each employee. These reports are the backbone of the UI system for several reasons: * **Accurate Benefit Payments:** When an individual files for unemployment, the Division of Unemployment Insurance uses these wage reports to verify their past earnings and determine their monetary eligibility and weekly benefit amount. Inaccurate or missing wage data can delay or incorrectly calculate benefits, directly impacting claimants. * **Correct Employer Premium Rates:** The experience rating system, which determines an employer's UI premium rate, is directly influenced by the wages reported and the benefits charged against an employer's account. If wages are underreported, it can lead to incorrect premium calculations, potentially disadvantaging compliant employers or shortchanging the trust fund. * **Federally Mandated Reports:** The state UI system operates under federal guidelines, and Colorado must submit regular reports to the U.S. Department of Labor. These reports rely on aggregated employer data to monitor the health of the national UI system and ensure compliance with federal laws like the Federal Unemployment Tax Act (FUTA). Speaking of FUTA, it's important to clarify what constitutes "wages" for unemployment tax purposes. **Payments defined as wages under the Federal Unemployment Tax Act (FUTA) payments for moving expenses if deduction is allowed in the federal internal revenue code (IRC), IRC 127** (referring to educational assistance programs) are examples of what can be considered taxable wages for UI purposes. This highlights that the definition of wages for unemployment tax purposes can be broader than just an employee's regular salary and can include various forms of compensation. Employers must be diligent in understanding and correctly reporting all forms of compensation that fall under this definition to ensure compliance with both state and federal regulations. Accurate reporting also helps in identifying and preventing fraud, ensuring that benefits are paid only to eligible individuals and that employers are paying their fair share of Colorado unemployment taxes.Protecting the System: Combating SUTA Dumping

The integrity of the unemployment insurance system, funded by Colorado unemployment taxes, is constantly under threat from fraudulent schemes. One such scheme, known as SUTA dumping, directly undermines the fairness and solvency of the UI trust fund. **SUTA (State Unemployment Tax Act) dumping refers to tax evasion schemes where an employer paying high unemployment insurance (UI) premiums attempt to shift their payroll and employees to another entity with a lower UI premium rate.** This illicit practice typically involves: * **Shell Corporations:** Creating new, seemingly independent businesses that are, in reality, controlled by the same individuals as the high-rate employer. * **Manipulating Ownership:** Transferring employees or payroll to an existing business that has a lower UI rate, often through changes in ownership structure that are designed solely to avoid higher UI taxes. * **"Experience Rate Shopping":** Actively seeking out or creating entities with low experience ratings to reduce overall UI tax liability, rather than improving their own employment stability. SUTA dumping is illegal and carries severe penalties, including fines, interest, and even criminal prosecution. It's a form of tax evasion that harms the entire system in several ways: * **Depletes the UI Trust Fund:** By avoiding their fair share of contributions, SUTA dumpers reduce the funds available to pay legitimate unemployment benefits, potentially leading to higher rates for all other compliant employers. * **Unfair Competition:** Businesses that engage in SUTA dumping gain an unfair competitive advantage over law-abiding employers who diligently pay their Colorado unemployment taxes. * **Increases Rates for Compliant Employers:** When the UI trust fund is depleted by fraudulent activities, the state may be forced to raise rates for all employers, including those who are fully compliant, to maintain solvency. * **Erodes Public Trust:** Such schemes undermine public confidence in the fairness and effectiveness of the unemployment insurance system. The Division of Unemployment Insurance actively monitors for SUTA dumping activities and has mechanisms in place to detect and prosecute those who engage in these schemes. Employers should be aware of this issue and understand that participating in or facilitating SUTA dumping is a serious offense with significant consequences. Maintaining transparency and integrity in payroll reporting and business structuring is paramount.Staying Compliant: Tips for Colorado Employers

For businesses operating in Colorado, navigating the landscape of Colorado unemployment taxes can seem complex, but compliance is non-negotiable. Adhering to state regulations not only prevents penalties but also contributes to the stability of the state's workforce and economy. Here are essential tips for employers to ensure they remain compliant: 1. **Understand Your Obligations:** Recognize that **most employers* are required to pay UI premiums if they meet** certain thresholds, typically related to payroll size or the number of employees. Familiarize yourself with these specific requirements as outlined by the Colorado Department of Labor and Employment (CDLE). 2. **Accurate Wage Reporting:** This is perhaps the most critical aspect of compliance. Submit accurate and timely quarterly wage reports. As highlighted, **information gathered from these reports is crucial to maintain the integrity of UI benefit payments, the accurate calculation of employer premium rates and federally mandated reports about the system.** Ensure all forms of taxable wages, as defined by FUTA and state law, are included. 3. **Monitor Your Premium Rate:** Annually, review the premium rate assigned to your business by the Division of Unemployment Insurance. Understand the factors that contributed to your rate, including your experience rating and whether a solvency surcharge is in effect. If you believe there's an error, contact the CDLE promptly. 4. **Respond to UI Claims Promptly:** When a former employee files for unemployment benefits, you will receive a notice. Respond to these notices accurately and within the specified timeframe. Your timely response helps the UI division make correct eligibility determinations and can prevent erroneous charges to your account. 5. **Maintain Good Record-Keeping:** Keep meticulous records of payroll, employee separation details, and all communications with the UI division. Good records are invaluable if you need to appeal a benefit claim or challenge a premium rate. 6. **Avoid SUTA Dumping:** As discussed, SUTA dumping is illegal and carries severe penalties. Ensure all your business structures and payroll transfers are legitimate and not designed to evade Colorado unemployment taxes. Transparency and ethical practices are key. 7. **Stay Informed of Changes:** Unemployment tax laws and regulations can change. Regularly check the CDLE website or subscribe to their updates to stay abreast of any modifications to rates, reporting requirements, or eligibility criteria. 8. **Seek Professional Advice:** If your business operations are complex, or you have specific questions about Colorado unemployment taxes, consult with a qualified tax professional or an attorney specializing in employment law. Their expertise can help you navigate intricate situations and ensure full compliance. Proactive management of your UI obligations is a cornerstone of responsible business practice in Colorado, safeguarding both your company's financial health and the broader UI system.The Future of Colorado Unemployment Taxes

The landscape of Colorado unemployment taxes is dynamic, constantly adapting to economic shifts, legislative changes, and technological advancements. The COVID-19 pandemic, for instance, highlighted the critical importance of a robust UI system and, at the same time, exposed vulnerabilities and the need for reform. While specific future changes are hard to predict, several ongoing trends and considerations will likely shape the future of Colorado unemployment taxes: * **Trust Fund Solvency:** Maintaining the solvency of the UI Trust Fund will remain a primary focus. Economic fluctuations directly impact the fund's balance, and policymakers will continue to monitor this closely. This could lead to adjustments in premium rates or the implementation of solvency surcharges, as has been the case in the past. * **Modernization of Systems:** The MyUI+ system represents a significant modernization effort, but continuous improvement in technology will be crucial for efficient claims processing and employer reporting. Future enhancements could further streamline interactions, improve data security, and provide more intuitive user experiences. * **Workforce Changes:** The evolving nature of work, including the rise of the gig economy and remote work, presents challenges to traditional UI models. Legislators may explore ways to adapt the system to cover a broader range of workers or adjust how wages are defined for UI purposes, potentially impacting Colorado unemployment taxes for certain businesses. * **Federal Influence:** The Federal Unemployment Tax Act (FUTA) provides the overarching framework for state UI systems. Any changes at the federal level could necessitate corresponding adjustments in Colorado's UI laws and how Colorado unemployment taxes are administered. * **Focus on Program Integrity:** Efforts to combat fraud, including SUTA dumping and other forms of benefit or tax evasion, will likely intensify. This ensures that the system remains fair for compliant employers and that benefits go to those genuinely eligible. The emphasis on accurate reporting and robust audit mechanisms will continue to be strong. The future of Colorado unemployment taxes will undoubtedly involve a balancing act: ensuring the UI trust fund remains healthy, providing adequate support to unemployed workers, and maintaining a fair and manageable system for employers. Staying informed and engaged with legislative developments will be key for all stakeholders.Conclusion

Understanding Colorado unemployment taxes is more than just a regulatory burden for businesses or a lifeline for individuals; it's a fundamental component of the state's economic resilience. From the intricate calculations of employer premiums, influenced by experience ratings and solvency surcharges, to the vital role of accurate reporting in maintaining system integrity, every aspect plays a part in supporting Colorado's workforce. For employers, compliance with UI premium payments and accurate reporting is not just about avoiding penalties; it's about contributing to a collective safety net that ultimately benefits the entire state economy. For individuals, knowing your eligibility and how to navigate systems like MyUI+ ensures that crucial support is accessible during periods of unemployment. The unemployment insurance system is a dynamic entity, constantly adapting to economic realities and legislative changes. By staying informed, adhering to regulations, and leveraging available resources, both employers and claimants can effectively navigate the complexities of Colorado unemployment taxes, ensuring the system continues to serve its vital purpose for years to come. We hope this comprehensive guide has shed light on this important topic. Do you have experiences with Colorado unemployment taxes you'd like to share, or further questions? Leave a comment below! And if you found this article helpful, consider sharing it with others who might benefit from this information. For more insights into navigating Colorado's business and employment landscape, explore our other articles. Back to Top

Colorado State Unemployment Tax Rate 2024 - Doria Georgie

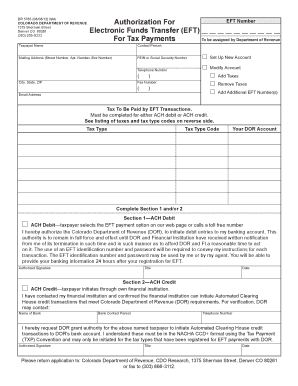

Unemployment Colorado - Fill and Sign Printable Template Online

5 updated numbers about unemployment in Colorado post COVID | 9news.com