Navigating 1099 Forms In Colorado: Your Essential Guide

Understanding your tax obligations can often feel like navigating a complex maze, especially when it comes to specific state requirements. For businesses and individuals operating within the Centennial State, comprehending the nuances of the 1099 form Colorado is not just good practice—it's a legal necessity. This comprehensive guide will demystify the process, ensuring you meet your filing requirements efficiently and accurately, safeguarding your financial well-being and compliance with state law.

From classifying workers correctly to understanding electronic filing mandates and specific state transmittal forms, every detail matters. Whether you're a business owner paying independent contractors, an individual receiving non-employee compensation, or simply seeking clarity on Colorado's unique tax landscape, this article serves as your definitive resource. We'll delve into the specifics, providing clear, actionable insights to help you confidently manage your 1099 responsibilities in Colorado.

Table of Contents

- Understanding the Basics of 1099 Forms in Colorado

- Which 1099 Forms Does Colorado Require?

- Colorado's Specific Filing Requirements for 1099 Forms

- Electronic vs. Paper Filing: What Colorado Prefers

- Key Deadlines and What to Do If You Receive a 1099

- Navigating Amendments and Prior Year Forms

- Special Considerations for Colorado Businesses

- Streamlining Your Colorado 1099 Filing Process

Understanding the Basics of 1099 Forms in Colorado

The 1099 form series is a critical component of the U.S. tax system, designed to report various types of income other than wages, salaries, and tips. These forms are primarily used by businesses to report payments made to non-employees, such as independent contractors, freelancers, and other service providers. For recipients, a 1099 form serves as an official record of income received, which must then be reported on their individual income tax returns. The federal government sets the baseline requirements, but individual states, including Colorado, often have their own specific mandates that businesses and individuals must adhere to.

The first and most crucial point to grasp is that, yes, Colorado requires all 1099 forms to be filed with the Colorado Department of Revenue. This isn't merely a suggestion; it's a mandatory requirement for any entity or individual that meets the state's specific criteria for reporting. This obligation ensures that the state has a clear picture of income earned within its borders, facilitating accurate tax collection and preventing potential tax evasion. For businesses, this means an added layer of compliance beyond federal filing, necessitating careful attention to detail and timely submission.

Furthermore, it's important to understand who exactly is subject to these filing requirements. In Colorado, businesses and individuals involved in specific financial transactions are required to file a 1099 form. This broad statement covers a range of scenarios, from a small business paying a freelance graphic designer to a property owner paying a contractor for repairs. The core principle is transparency: if you're paying someone for services or certain other types of income without withholding traditional employment taxes, the state wants to know about it. Failing to comply can lead to penalties, audits, and a significant administrative burden, underscoring the importance of proactive compliance and a thorough understanding of the state's expectations.

Which 1099 Forms Does Colorado Require?

While the federal government recognizes numerous types of 1099 forms, each designated for specific income categories (e.g., 1099-NEC for non-employee compensation, 1099-MISC for miscellaneous income, 1099-INT for interest, 1099-DIV for dividends), the question for Colorado taxpayers often boils down to: Which forms does Colorado require? Generally, if a federal 1099 form is required for a payment, and that payment has a Colorado state income tax withholding component, then a corresponding filing with the Colorado Department of Revenue is also required. This ensures that the state can reconcile any state income tax that was withheld from these payments.

A key directive from the state clarifies this: Colorado mandates the submission of Form 1099 for Tax Year 2024 if state income taxes were withheld. This is a critical distinction. Unlike some states that might require all federal 1099s to be filed regardless of state withholding, Colorado's primary trigger for direct state filing is the presence of state income tax withholding. This means if you paid an independent contractor, for example, and you were required to withhold Colorado income tax from their payments, you must then file the relevant 1099 form (typically 1099-NEC) with the Colorado Department of Revenue, in addition to the IRS.

To elaborate on this, if Colorado tax is required to be withheld for any income earned, payers are required to submit the appropriate 1099 forms to the state. This requirement applies across various income types reported on 1099s, such as non-employee compensation, rents, royalties, or other income where state withholding was necessary. The state's focus is on ensuring that any state tax collected at the source is properly reported and accounted for. This system helps the Colorado Department of Revenue track potential tax liabilities and ensures that individuals and businesses are meeting their state tax obligations accurately. Understanding this specific trigger for filing with the state is paramount for businesses to remain compliant and avoid any discrepancies between their federal and state tax reporting.

Colorado's Specific Filing Requirements for 1099 Forms

When it comes to fulfilling your tax duties in the state, businesses often find themselves asking, Looking for Colorado 1099 filing requirements? The answer lies in understanding the state's unique approach to these informational returns. Colorado's requirements are not just a mirror image of federal mandates; they have their own specific triggers and associated forms that must be addressed.

A significant aspect of Colorado's mandate is that the state of Colorado mandates 1099 filing based on the amount of state taxes withheld, rather than simply mirroring all federal 1099 filings. This means that if you, as a payer, withheld Colorado state income tax from payments made to a contractor or other payee, then you are obligated to file the corresponding 1099 form directly with the state. This distinction is crucial for businesses to recognize, as it narrows the scope of state-specific 1099 filings compared to a blanket requirement for all federal 1099s.

To reiterate this point clearly, if Colorado state tax is withheld, you must file 1099 forms directly with the state. The payer must file the form. This emphasizes the responsibility of the entity making the payment and withholding the tax. It’s not the recipient’s duty to file the 1099 with the state; it’s the payer’s. This ensures that the Colorado Department of Revenue has a record of the withheld funds and can match them to the recipient's income. This direct filing requirement is a cornerstone of Colorado's income tax collection system for non-wage income.

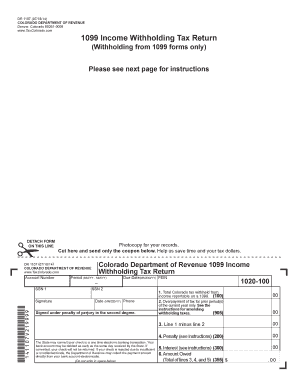

To comply with these specific requirements, businesses need to be familiar with certain Colorado Department of Revenue forms. Specifically, you should check the filing requirements of Form DR 1106 and Form DR 1101. Form DR 1106, titled "Annual Transmittal of State 1099s," is particularly important. This form serves as a summary transmittal for all the 1099 forms you are submitting to the state. The DR 1106 Annual Transmittal of State 1099s should be filed in January for withholding taxes reported on federal Form 1099. This January deadline aligns with the federal deadline for mailing 1099s to recipients, emphasizing the need for timely preparation and submission. Form DR 1101 is typically related to declarations of estimated tax or withholding, further underscoring the interconnectedness of various state tax forms in Colorado's system. Ensuring that these transmittal forms are correctly completed and submitted alongside the individual 1099s is vital for complete compliance.

Electronic vs. Paper Filing: What Colorado Prefers

In today's digital age, tax authorities are increasingly moving towards electronic filing to enhance efficiency, accuracy, and security. The Colorado Department of Revenue is no exception, strongly encouraging and, in many cases, mandating electronic submission for 1099 forms. This push towards digitalization aims to streamline the processing of tax information, reduce errors, and provide a more convenient experience for taxpayers.

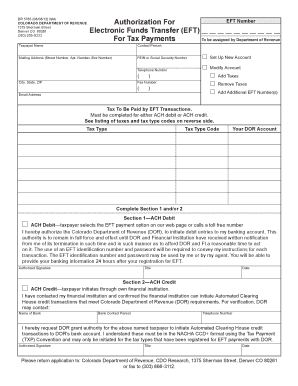

For larger filers, the preference for electronic submission becomes a firm requirement. Any issuer with more than 250 payees must submit 1099 statements electronically through Revenue Online www.colorado.gov/revenueonline. This threshold is a clear indicator that the state expects high-volume filers to leverage its online portal. Electronic filing through Revenue Online offers numerous benefits, including instant confirmation of submission, reduced risk of mail delays or loss, and often, faster processing. It's a secure platform designed to handle sensitive tax data efficiently, making it the preferred method for businesses managing a significant number of 1099s.

While electronic filing is mandated for larger volumes, smaller businesses may still have the option for paper submission. However, even for those, the state encourages electronic methods whenever possible. If you are considering submitting paper 1099 statements to... the Colorado Department of Revenue, it's crucial to ensure you have the correct forms and mailing addresses, and that your submission is legible and complete. The state prefers electronic methods due to the sheer volume of forms they process annually, and paper submissions can be subject to longer processing times and a higher chance of errors.

Furthermore, for businesses that manage their withholding taxes electronically, there are specific guidelines to follow. Visit www.colorado.gov/revenue/eft for information on how to register and pay through EFT. Electronic Funds Transfer (EFT) is a secure and efficient way to remit tax payments, including those associated with 1099 withholding. When you utilize EFT for your withholding payments, it directly impacts your filing requirements for associated forms. Specifically, do not file a paper DR 1107 if you remitted the withholding taxes via EFT. Form DR 1107 is typically a payment voucher or transmittal for withholding taxes. If the payment has already been made electronically via EFT, submitting a paper DR 1107 would be redundant and could lead to confusion or processing delays. This highlights the importance of understanding the interconnectedness of Colorado's electronic payment and filing systems to avoid unnecessary paperwork and ensure accurate reporting.

Key Deadlines and What to Do If You Receive a 1099

Understanding the deadlines for 1099 forms is crucial for both payers and recipients to ensure timely compliance and avoid penalties. For payers, the primary deadline for issuing 1099 forms to recipients is consistent with federal requirements: 1099 forms will be mailed out by January 31st. This means businesses must have these forms prepared and sent to their independent contractors and other payees by the end of January following the tax year. This deadline is critical for recipients to have the necessary information to file their own tax returns accurately.

For recipients, once you receive your 1099 form, it's important to understand what to do next. The first step is to carefully review the information on the form to ensure its accuracy. If you notice any discrepancies, you should immediately contact the payer to request a correction. If you haven't received your 1099 by early February, it's advisable to reach out to the payer. Please allow 10 mailing days before requesting a duplicate, as mail delivery can sometimes be delayed. After that grace period, if the form still hasn't arrived, contact the issuer to request a duplicate copy.

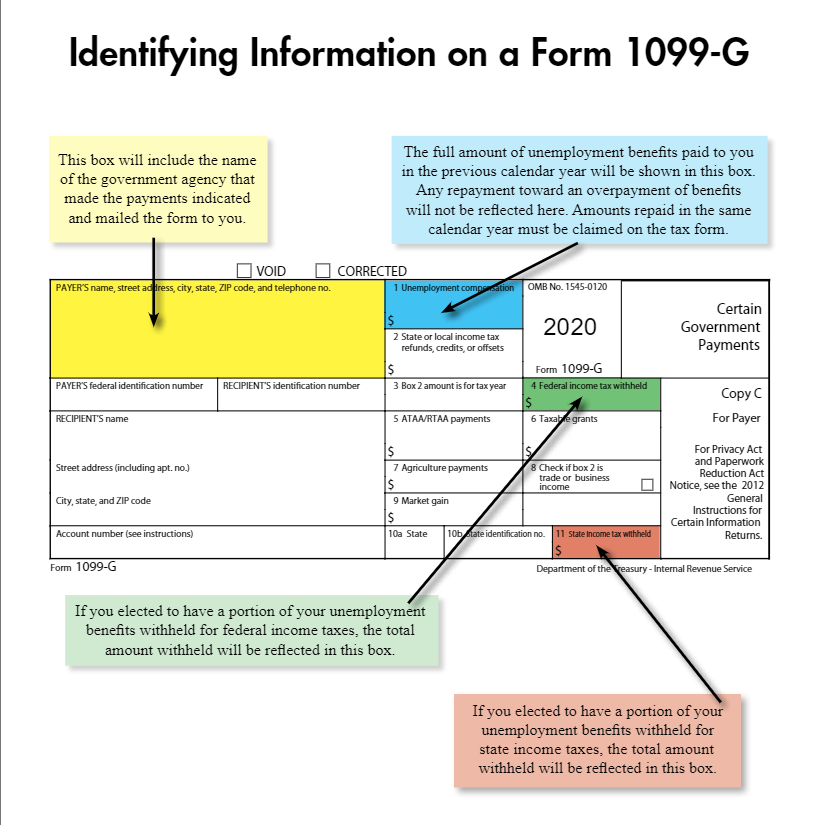

Once you've received and verified your 1099 form, the next question is often, I just received a 1099 form, what do I do with it? The answer is straightforward: this form is essential for preparing your individual income tax return. The income reported on your 1099-NEC, for example, represents your gross earnings from self-employment or contract work. Clients must report taxes on the... income shown on these forms when they file their personal income tax returns. This income is typically reported on Schedule C (Form 1040), Profit or Loss from Business, where you can also deduct eligible business expenses to arrive at your net taxable income.

When it comes to filing your individual income tax return in Colorado, the 1099 forms you receive will directly impact your state tax liability. File your individual income tax return, submit documentation electronically, or apply for a PTC rebate. The income reported on your 1099s will be part of your total gross income, which is then used to calculate your Colorado state income tax. Colorado offers various methods for filing your individual return, including electronic submission through the state's Revenue Online portal or through tax software. Additionally, some Colorado residents may be eligible for a Property Tax/Rent/Heat Credit (PTC) rebate, which is a separate program designed to provide relief to low-income seniors and individuals with disabilities, and while not directly tied to 1099s, it's part of the broader individual tax filing landscape in the state. Ensuring all income, including that reported on 1099s, is accurately accounted for on your state return is crucial for compliance.

Navigating Amendments and Prior Year Forms

Even with the most meticulous preparation, errors can sometimes occur on tax forms. When this happens with a 1099 form, either on the payer's or recipient's side, an amendment becomes necessary. Amending a 1099 form involves correcting previously submitted information and resubmitting it to the relevant tax authorities. For payers, this typically means issuing a corrected 1099 to the recipient and filing the corrected form with the IRS and, if applicable, the Colorado Department of Revenue. If you are filing an amended return you are required to mark the... "corrected" box on the form. This clearly indicates to the tax agencies that this submission supersedes a previous one, preventing confusion and ensuring the most accurate information is on file. It's a critical step to maintain compliance and avoid potential discrepancies that could lead to notices or audits.

Another common scenario involves needing access to older tax forms. Tax laws and forms can change from year to year, and sometimes, for various reasons like audit requests or personal record-keeping, you might need a version of a form from a previous tax year. The Colorado Department of Revenue's website typically prioritizes the most current versions of its forms. As such, only the most recent version of each form is published on this page (referring to the state's official tax forms page). This is standard practice for tax agencies, as it ensures taxpayers are always using the most up-to-date forms for current filings.

However, if your needs extend to historical forms, the state provides a direct channel for assistance. If you are looking for a prior year form, please email dor_taxpayerservice@state.co.us. This dedicated email address for taxpayer services is an invaluable resource for obtaining specific versions of forms that are no longer readily available on the public website. It underscores the Colorado Department of Revenue's commitment to assisting taxpayers with their unique needs, even when those needs involve delving into past tax periods. Always ensure you specify the exact tax year and form number you require when making such a request to expedite the process and receive the correct documentation.

Special Considerations for Colorado Businesses

Operating a business in Colorado comes with its own set of unique tax considerations beyond the general 1099 filing requirements. These nuances often involve how businesses classify their workers, how certain state-specific benefits are treated for tax purposes, and how to effectively respond to communications from the Colorado Department of Revenue. Understanding these specific areas is vital for comprehensive compliance and smooth business operations.

Classifying Workers: Employee vs. Independent Contractor

One of the most common pitfalls for businesses, particularly those utilizing a flexible workforce, is the misclassification of workers. The distinction between an employee and an independent contractor is not merely semantic; it carries significant legal and tax implications for both the business and the worker. A critical point to remember is that paying someone with a 1099 does not make them a contractor. Issuing a 1099-NEC only reports payments made to a non-employee; it doesn't automatically validate their status as an independent contractor. The classification depends on the nature of the working relationship, specifically the degree of control and independence. Misclassification can lead to substantial penalties, including back taxes, interest, and fines for unpaid payroll taxes, unemployment insurance, and workers' compensation.

To help businesses navigate this complex area, our statute outlines the minimum criteria to consider when establishing a working relationship. These criteria typically revolve around behavioral control (does the business control how the work is done?), financial control (does the business control the business aspects of the worker's job?), and the type of relationship (are there written contracts, benefits, or permanency?). Businesses must carefully evaluate these factors for each worker. Furthermore, you must either obtain workers’... compensation insurance for employees or ensure that genuinely independent contractors meet specific statutory exemptions. The Colorado independent contractor guidelines offer useful information that will help you classify your workers properly. These guidelines are indispensable resources, providing detailed explanations and examples to assist businesses in making informed decisions. It is critical to understand the manpower aspect of your business to avoid... costly legal and tax repercussions. Proper classification is not just about avoiding penalties; it's about fostering a fair and legally sound working environment.

Understanding FAMLI Benefits and 1099s

Colorado has implemented the Family and Medical Leave Insurance (FAMLI) program, which provides paid leave benefits to eligible workers for various life events. A common question arises regarding the taxability of these benefits. It's important for both employers and recipients to know that FAMLI benefits are not subject to Colorado state income tax but they may be subject to federal income tax. This distinction is crucial for individuals receiving these benefits when preparing their state and federal tax returns. While Colorado has chosen not to tax these benefits at the state level, the IRS may view them as taxable income, requiring them to be reported on federal income tax returns.

To be absolutely clear, Colorado does not tax FAMLI benefits. This simplifies the state tax implications for recipients, as they won't need to account for these benefits as taxable income on their Colorado state income tax return. For employers, this means there are no state withholding requirements for FAMLI benefits paid out. To stay informed about the FAMLI program and its evolving guidelines, the state provides resources. FAMLI has two newsletters, one for employers and businesses and the second for Colorado health care providers. Subscribe and choose what topics you want to hear more about. These newsletters are excellent ways to receive direct updates and clarifications on the program, ensuring businesses and individuals remain compliant with the latest regulations regarding FAMLI benefits and their tax treatment.

Responding to Colorado Department of Revenue Notices

Receiving a notice from the Colorado Department of Revenue can be a cause for concern, but it's important to respond promptly and appropriately. These notices can range from requests for additional information to assessments of deficiencies or rejections of refund claims. If you received a notice of deficiency or rejection of refund claim from the Colorado Department of Revenue, there are a few ways you can respond. Your response will depend on the nature of the notice and whether you agree with the department's findings.

Common responses include:

- Providing additional documentation: If the notice is a request for more information, gather and submit the requested documents promptly.

- Paying the amount due: If you agree with a deficiency assessment, you can pay the amount owed by the specified deadline.

- Disputing the findings: If you disagree with the assessment or rejection, you have the right to appeal. This usually involves submitting a written protest explaining your position and providing supporting evidence.

Streamlining Your Colorado 1099 Filing Process

The complexities of 1099 filing, particularly when factoring in state-specific requirements like those in Colorado, can be daunting for businesses of all sizes. Fortunately, various tools and services exist to help streamline this process, making compliance more manageable and less prone to error. The goal is to meet your Colorado 1099 filing requirements efficiently, ensuring accuracy and timeliness without excessive administrative burden.

One common approach is to utilize third-party filing services. Companies like TaxBandits specialize in electronic filing of various tax forms, including 1099s, with both the IRS and many state agencies. Such services can simplify the process by providing user-friendly interfaces, error-checking features, and direct electronic submission capabilities. They often handle the complexities of different state formats and requirements, saving businesses significant

1099 Income Withholding Tax Return - Colorado - Fill and Sign Printable

What is a Form 1099-G? – Thomas & Company

Unemployment Colorado - Fill and Sign Printable Template Online