Unlock Your Dream Home: Navigating Chase Home Loan Rates

Embarking on the journey to homeownership or considering refinancing your existing mortgage can be both exciting and daunting. One of the most critical factors influencing your decision, and indeed your long-term financial health, is understanding mortgage rates. Specifically, if you're looking at a major financial institution, delving into Chase home loan rates is a crucial first step. With the dynamic nature of the housing market and economic indicators, staying informed about current offerings is paramount to making a sound financial choice.

Understanding Chase Bank home loan rates in 2024 can feel overwhelming at first, but with the insights provided here, you can navigate through them with confidence. This comprehensive guide will equip you with the knowledge to compare current mortgage rates across a variety of mortgage products from Chase, helping you identify the best option for your unique financial situation. We'll explore everything from daily average mortgage rate trends to specific payment examples, ensuring you have a clear picture before you decide to apply for a mortgage today.

Table of Contents

- Understanding Chase Home Loan Rates: An Overview

- Why Choose Chase for Your Mortgage?

- Current Chase Mortgage Rates and Examples

- Types of Home Loan Products from Chase

- Factors Influencing Your Chase Home Loan Rate

- Comparing Chase Rates with the Market

- Navigating the Application Process with Chase

- Forecasting Mortgage Rates for 2025

Understanding Chase Home Loan Rates: An Overview

When you're in the market for a new home or considering refinancing, the term "mortgage rates" is likely at the forefront of your mind. These rates, essentially the cost of borrowing money for your home, fluctuate based on a myriad of economic factors. For a financial giant like Chase, their home loan rates are a significant indicator of market trends and their competitive positioning. Chase Bank offers mortgage products that cater to those who are requiring finance to purchase a house or refinance an existing home loan, making it a comprehensive solution for many aspiring homeowners and current property owners.

It’s not just about the percentage number; it's about understanding what that rate means for your monthly budget and long-term financial commitment. Reviewing current mortgage rates, tools, and articles is crucial to help you choose the best option. This article aims to be that guiding light, specifically focusing on how Chase structures its offerings and what you can expect when exploring their home loan products.

Why Choose Chase for Your Mortgage?

Chase is one of the largest and most well-known banks in the United States, offering a vast array of financial services, including robust mortgage solutions. One compelling reason to consider Chase for your home financing needs is their competitive edge. Chase offers a wide range of home loan products with annual percentage rates (APRs) that tend to be lower than the market average. This competitive pricing can translate into significant savings over the life of your loan, making your dream home more affordable.

Beyond just competitive rates, Chase also provides a comprehensive suite of tools and resources designed to simplify the mortgage process. From online calculators to dedicated loan officers, they aim to make the journey from application to closing as smooth as possible. Their extensive network and long-standing reputation in the financial industry also provide a sense of security and trustworthiness, which is invaluable when making such a significant financial commitment. Checking the most current and competitive mortgage rates when choosing a home loan with Chase Mortgage ensures you're getting a favorable deal tailored to your financial profile.

Current Chase Mortgage Rates and Examples

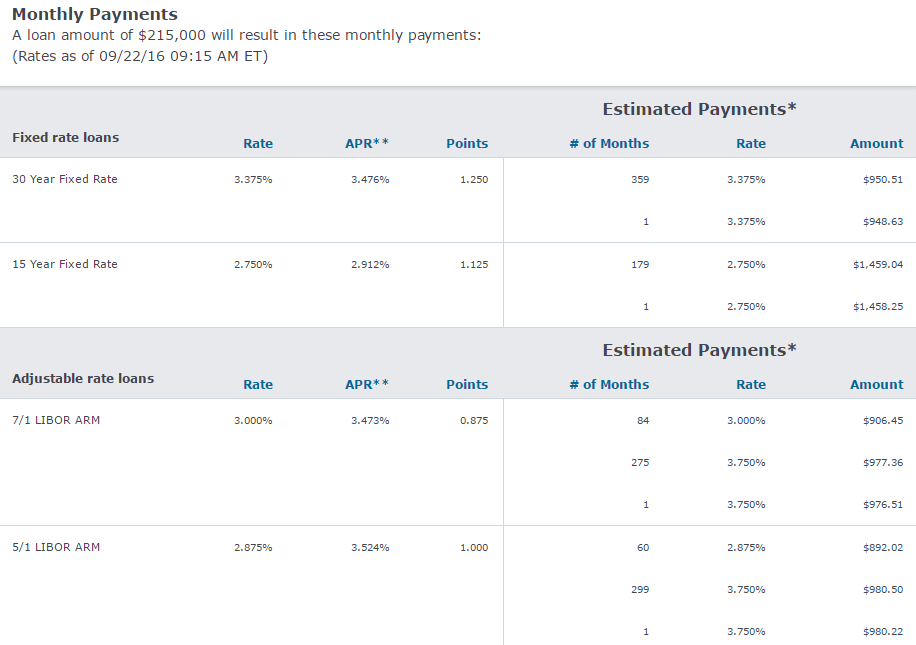

The most immediate question on anyone's mind is, "What are the current Chase mortgage rates today?" While rates are dynamic and subject to daily fluctuations, the data available provides a snapshot that can guide your expectations. According to recent information, Chase mortgage rates today range from 5.91% for a 15-year mortgage to 6.35% for a 30-year refinance. These figures offer a starting point, but your specific rate will depend on various personal financial factors, which we will delve into later.

15-Year Fixed Mortgage

A 15-year fixed mortgage is often appealing to borrowers who want to pay off their home loan faster and typically benefit from lower interest rates compared to 30-year terms. With a shorter repayment period, your monthly payments will be higher, but you'll pay significantly less interest over the life of the loan. For example, if you're considering a $500,000 15-year mortgage with Chase, and assuming a rate around 5.91%, the monthly payment for a $500,000 15-year mortgage would be $4,195.01. This substantial monthly outlay highlights the commitment required for a shorter term, but also the accelerated path to debt-free homeownership.

30-Year Refinance Options

Refinancing is a strategic move for many homeowners looking to reduce their

chase mortgage rates jumbo

33+ chase refinancing mortgage rates - CarralNyree

Chase Mortgage and Home Equity review | Top Ten Reviews