Unlocking Unsecured Funds: Is A Chase Signature Loan Right For You?

Navigating the world of personal finance can often feel like deciphering a complex puzzle, especially when you're looking for flexible borrowing options. One term that frequently surfaces in discussions about unsecured debt is the "signature loan." This type of loan, valued for its simplicity and lack of collateral requirements, often appeals to individuals seeking quick access to funds. However, when the search narrows to specific institutions like Chase, understanding their offerings becomes paramount. Do they provide traditional signature loans, or do their financial products serve a similar purpose under a different structure? This article will delve into the intricacies of signature loans, explore Chase's relevant financing options, and help you determine the best path for your financial needs.

For many, the idea of a signature loan conjures images of straightforward borrowing – a simple agreement based primarily on your promise to repay, backed by your creditworthiness. This concept holds significant appeal for those who don't have assets to pledge as collateral or prefer not to. As we explore the landscape of unsecured lending, we'll specifically examine how Chase, a major financial institution, addresses the need for personal financing. We'll differentiate between a general signature loan and Chase's unique credit card-based solutions, "My Chase Loan" and "Chase Pay Over Time," ensuring you have a clear understanding of what's available and what might be the best fit for your financial journey.

Table of Contents

- Understanding Signature Loans: The Unsecured Advantage

- Does Chase Offer Traditional Signature Loans? A Closer Look

- My Chase Loan: An Alternative to Traditional Personal Loans

- Chase Pay Over Time: Another Credit Card Financing Option

- Comparing Chase's Credit Card Financing to Traditional Signature Loans

- Other Lending Options from Chase (Beyond Unsecured Personal Loans)

- Navigating Your Personal Loan Journey: What to Consider

- Making Informed Financial Decisions with Chase and Beyond

Understanding Signature Loans: The Unsecured Advantage

Before we dive into specific offerings, it's crucial to grasp what a signature loan truly entails. A signature loan is a type of unsecured personal loan, meaning it doesn't require any collateral, such as a car or a house, to secure the borrowed funds. Instead, the lender relies solely on your promise to repay, which is formalized by your signature on the loan agreement. This reliance is primarily based on your creditworthiness and income, making your financial history and current earning capacity the key determinants for approval.

What Defines a Signature Loan?

At its core, a signature loan is an unsecured personal loan offered by various financial entities, including online lenders, traditional banks, or credit unions. The defining characteristic is the absence of collateral; your signature is the only security. These loans are commonly used when borrowers need quick and accessible funds for a variety of purposes, from consolidating high-interest debt to covering unexpected expenses or financing a major purchase. With a signature loan, you receive a fixed amount, and the amount you can borrow typically varies by lender and your individual financial profile. Unlike a payday loan, which often requires full repayment in a single lump sum, signature loans typically offer fixed repayment terms, meaning you’ll repay the money in regular installments according to the loan agreement.

Why Choose a Signature Loan?

Signature loans offer several compelling advantages. For one, they provide access to funds without requiring you to put up valuable assets, which can be a significant relief for many borrowers. Furthermore, they often come with more attractive rates than other types of unsecured debt, especially when compared to high-interest credit cards or payday loans. Because they are based on your credit and income, rather than collateral, they can be a flexible solution for a wide range of financial needs. Applying for a signature loan generally involves providing personal information like your name and address, and the lender will assess your credit profile to determine eligibility and terms. Comparing offers for signature loans online can help you find the best terms available from various lenders.

Does Chase Offer Traditional Signature Loans? A Closer Look

When consumers search for "signature loan Chase," they are often looking for a straightforward, unsecured personal loan directly from the bank. However, it's important to clarify that Chase's primary offerings in the realm of unsecured personal financing are typically structured differently from what is commonly understood as a traditional signature loan. While many banks and online lenders explicitly market "signature loans" as standalone personal loans requiring a new application and credit check, Chase's approach focuses on leveraging existing customer relationships, particularly through credit cards.

The Nuance of "Signature Loan Chase"

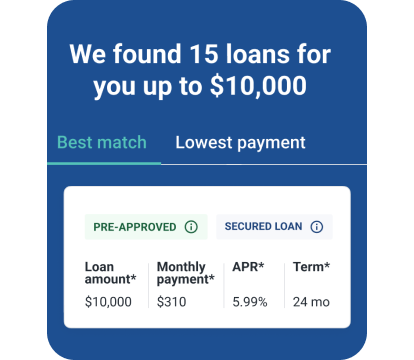

The term "signature loan Chase" can be a bit misleading if one expects a product identical to those offered by other lenders. Based on available information, Chase primarily offers two financing options for credit card charges: My Chase Plan and My Chase Loan. These are not traditional, standalone personal loans that you apply for separately with a new credit inquiry. Instead, they allow you to borrow money from your existing credit card’s available credit line. This distinction is crucial: unlike traditional loans, with My Chase Loan, there’s no need for a separate application, a new credit check, or a separate account to manage. This makes the process incredibly streamlined for existing Chase credit card holders, but it also means it's not a "new" loan in the conventional sense, but rather a feature of your existing credit product. JPMorgan Chase does offer "personal loan plans starting at $500," but these are often tied into the credit card financing options like My Chase Loan, with the limit entirely based on the purchasing and credit profile of the cardholder.

My Chase Loan: An Alternative to Traditional Personal Loans

For those seeking flexible unsecured financing from Chase, My Chase Loan stands out as a key offering. It's designed to provide a convenient way to access funds from your existing credit card without the typical hurdles associated with new loan applications. This makes it a unique proposition in the personal finance landscape, catering specifically to Chase credit card holders.

How My Chase Loan Works

My Chase Loan allows you to borrow money directly from your credit card’s available credit line. The process is remarkably simple: there's no application or credit check needed beyond your initial credit card approval. This means you can discover how to get a loan from your credit card’s available credit line with My Chase Loan quickly and efficiently. The funds are typically deposited directly into your linked bank account. Once you receive the funds, you repay the loan in fixed monthly installments over a set period, similar to a traditional installment loan. This structure provides predictability in your repayment schedule, making it easier to budget. The fees or interest charges associated with My Chase Loan are usually lower than your regular annual percentage rate (APR) for purchases, offering a potentially more affordable way to access cash than a standard cash advance.

Benefits and Considerations of My Chase Loan

The primary benefit of My Chase Loan is its unparalleled convenience. Since it leverages your existing credit card, you avoid the time-consuming application processes and credit inquiries typically associated with new personal loans. This can be particularly advantageous if you need quick access to funds and want to avoid impacting your credit score with another hard inquiry. The fixed repayment terms and potentially lower interest rates compared to standard credit card APRs also make it an attractive option for managing larger expenses. However, it's essential to consider that the loan amount is limited by your credit card's available credit, and while the interest rates might be lower than your card's purchase APR, they might still be higher than what you could secure with a traditional signature loan from another lender if you have excellent credit. Always compare offers and understand all fees before committing.

Chase Pay Over Time: Another Credit Card Financing Option

Beyond My Chase Loan, Chase offers another flexible financing solution for its credit card customers: Chase Pay Over Time. While distinct from My Chase Loan, both serve a similar purpose in allowing cardholders to manage large credit card purchases with more structured repayment plans and potentially lower interest rates than their standard APR. Chase offers Chase Pay Over Time and My Chase Loan as two ways to pay down a large credit card purchase.

Chase Pay Over Time, much like My Chase Loan, is not a separate signature loan in the traditional sense. Instead, it allows you to convert specific, eligible credit card purchases into fixed-term installment plans. This means that instead of carrying a large balance at your regular credit card APR, you can opt to pay off that specific purchase over a set number of months with a fixed monthly payment and a special, often lower, interest rate. This can be incredibly useful for budgeting and avoiding the compounding interest that can quickly accrue on large credit card balances. Each option, whether My Chase Plan (often interchangeable with Pay Over Time in concept) or My Chase Loan, comes with its own fees or interest charges that are usually lower than your regular annual percentage rate (APR) and can provide a clear path to debt repayment for specific expenses.

Comparing Chase's Credit Card Financing to Traditional Signature Loans

It's vital to distinguish between Chase's credit card-based financing options and what is generally understood as a traditional signature loan offered by other banks or online lenders. While both are unsecured and offer fixed repayment terms, their underlying mechanisms and application processes differ significantly.

A traditional signature loan is a standalone product. To apply for a signature loan, you typically go to the lender's website, call customer service, or go in person to a branch. The lender will need some personal information like your name, address, and will perform a credit check to assess your creditworthiness. This process can involve a hard inquiry on your credit report, which might temporarily lower your score. Signature loans generally refer to a type of unsecured loan issued by a bank or other lender based on your creditworthiness, and they’re commonly used when borrowers need quick and substantial funds not tied to a specific purchase or existing credit line. They are ideal for debt consolidation, home improvements, or large unexpected expenses, offering a fixed amount and fixed repayment terms.

In contrast, My Chase Loan and Chase Pay Over Time are features of your existing Chase credit card. As mentioned, there’s no need for a separate application or credit check. You’re borrowing from your already approved credit line. This offers immense convenience and speed, but it also means the amount you can borrow is capped by your credit card's available credit. While their interest rates are often lower than your standard credit card APR, they might not always compete with the lowest rates available on traditional signature loans for borrowers with excellent credit. So, while Chase doesn't appear to offer a traditional "signature loan" product that requires a new, separate application and credit check outside of your credit card relationship, their credit card financing options provide a similar function for existing customers. It may be worth seeking out other options if you require a larger sum, or if you prefer a loan entirely separate from your credit card accounts.

Other Lending Options from Chase (Beyond Unsecured Personal Loans)

While the focus of this article is on "signature loan Chase" and unsecured personal financing, it's worth noting that Chase, as a full-service financial institution, offers a broad spectrum of lending products. These options cater to various life stages and financial needs, though they differ significantly from the unsecured personal loans we've discussed.

For instance, Chase is a prominent lender for secured loans like auto financing and mortgages. You can apply for auto financing for a new or used car with Chase, and they provide tools like a payment calculator to estimate monthly payments. They also offer a Chase Auto Education Center to get car guidance, demonstrating their commitment to supporting customers through major purchases. Similarly, for homeownership, Chase provides resources to help make smart mortgage decisions and feel informed with their tools. These secured loans require collateral (the car or the home) and typically involve a comprehensive application and underwriting process, distinguishing them entirely from signature loans or credit card-based financing.

Understanding the full range of Chase's lending options can help you find lending solutions for where you're at in life, on your terms. While they might not offer a product explicitly named a "signature loan" in the traditional sense, their diverse portfolio aims to help you build a financial plan and get the resources you need, whether it's for a car, a home, or flexible financing through your credit card.

Navigating Your Personal Loan Journey: What to Consider

Regardless of whether you're considering a traditional signature loan from another lender or utilizing Chase's credit card-based financing, embarking on any personal loan journey requires careful consideration. Your financial health and future depend on making informed decisions.

First, always assess your true need for the funds. Is it a want or a necessity? Understanding the purpose of the loan will help you determine the appropriate amount and repayment timeline. Next, evaluate your ability to repay. Signature loans typically offer fixed repayment terms, meaning you’ll repay the money in regular installments according to the loan agreement. Ensure that these installments fit comfortably within your monthly budget without straining your finances. Consider the total cost of the loan, including any fees and the interest rate. While My Chase Loan and Chase Pay Over Time may offer rates lower than your credit card's standard APR, compare these to rates from other lenders offering traditional signature loans. Signature loans offer the best terms — they only require your signature as collateral and typically offer more attractive rates than other types of unsecured debt, so exploring all options is crucial.

Furthermore, be aware of the application process. For traditional signature loans, you'll need to provide personal information like your name, address, and financial details. The lender will use your credit and income to qualify you, rather than collateral. For My Chase Loan, the process is much simpler, leveraging your existing credit card relationship. Finally, always read the fine print. Understand all terms and conditions, including any penalties for late payments or early repayment. Being well-informed is your best defense against unexpected financial burdens.

Making Informed Financial Decisions with Chase and Beyond

The landscape of personal finance is vast, offering numerous paths to securing funds. When considering a "signature loan Chase," it becomes clear that Chase primarily offers credit card-based financing solutions like My Chase Loan and Chase Pay Over Time, which serve as convenient alternatives to traditional personal loans for their existing cardholders. These options provide a streamlined way to access funds from your available credit line, often with more favorable terms than a standard cash advance.

However, if you're seeking a standalone unsecured personal loan that isn't tied to your credit card, or if you need a larger sum than your credit card's limit allows, it's important to recognize that traditional signature loans are widely available from other online lenders, banks, and credit unions. These loans operate on your creditworthiness and income, offering fixed amounts and repayment terms that can be tailored to various financial needs. Exploring the ins and outs of these options and comparing offers is key to finding the best fit for your unique situation.

Ultimately, making smart financial decisions involves thorough research, understanding the nuances of different loan products, and assessing your personal financial situation honestly. Whether you choose to leverage Chase's convenient credit card financing or opt for a traditional signature loan from another provider, the goal remains the same: to secure the funds you need on terms that support your financial well-being. Always weigh the pros and cons, compare rates, and choose the option that aligns best with your financial goals.

What are your thoughts on Chase's credit card financing options versus traditional signature loans? Share your experiences or questions in the comments below!

CDN$1,500,000,000 AMENDED AND RESTATED CREDIT AGREEMENT among CGI GROU

What Is a Signature Loan? - Experian

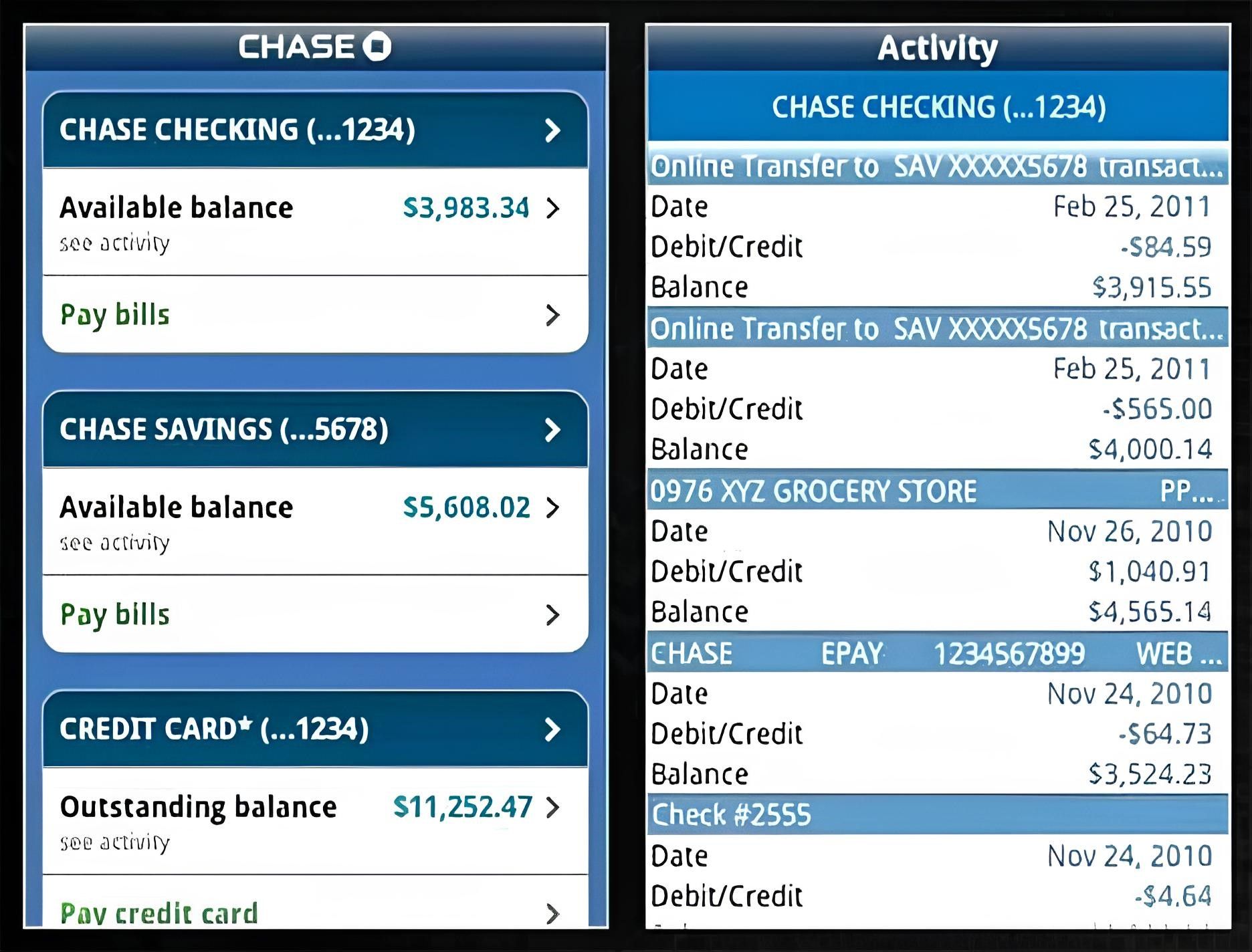

A Step-by-Step Guide To Take Screenshot Chase Bank Account Balance 2025