Navigating Fort Bend Property Taxes: Your Essential Guide

Table of Contents

- Understanding Fort Bend Property Taxes: The Basics

- Decoding Your Fort Bend Property Tax Statement

- Navigating the Fort Bend County Tax Office Resources

- Key Entities Influencing Fort Bend Property Taxes

- Exemptions and Relief Programs for Fort Bend Property Taxes

- Understanding Delinquent Fort Bend Property Taxes and Tax Certificates

- Tips for Managing Your Fort Bend Property Tax Burden

- The Future of Fort Bend Property Taxes

Understanding Fort Bend Property Taxes: The Basics

Property taxes in Texas, including Fort Bend County, are primarily levied at the local level, meaning there is no state property tax. Instead, local taxing units – such as counties, school districts, cities, and various special districts – set their own tax rates to fund the services they provide. For homeowners, this means that your total Fort Bend property taxes are an aggregation of the taxes imposed by each of these entities that have jurisdiction over your specific property. These funds are indispensable for maintaining the quality of life and infrastructure that Fort Bend County residents enjoy, contributing directly to the vibrant growth and development seen across the region. The system is designed to ensure that property owners contribute equitably to the public services from which they benefit. While the concept might seem straightforward, the details of how property values are assessed and how tax rates are determined can be quite intricate. A clear understanding of these foundational elements is the first step towards effectively managing your property tax obligations in Fort Bend County.Who is Responsible for Collecting Fort Bend Property Taxes?

In Fort Bend County, the primary responsibility for assessing property values and collecting property taxes falls to the Fort Bend County Tax Assessor-Collector's Office. This office serves as the central hub for all property tax-related matters, acting on behalf of numerous taxing units within the county. They are tasked with ensuring that property values are appraised fairly and that taxes are collected efficiently to support the various public services. Their role is pivotal in the local financial ecosystem, providing the necessary revenue streams for schools, emergency services, and other vital community functions. The convenience for taxpayers is a key focus. For instance, **residents of the village of Pleak, Fort Bend County LID #2, Fort Bend ESD #10, & The Park at Eldridge PID can now pay their property taxes at any of our Fort Bend County tax office locations.** This flexibility underscores the county's commitment to making the payment process as accessible as possible for its diverse population. The Tax Assessor-Collector's office also provides a range of services beyond just collection, including answering taxpayer questions and offering resources for understanding tax statements and exemptions.How Fort Bend Property Taxes are Calculated

The calculation of your Fort Bend property taxes is a two-step process: appraisal and application of tax rates. First, your property's market value is determined by the Fort Bend Central Appraisal District (CAD). This appraisal district is separate from the Tax Assessor-Collector's office and is responsible for appraising all taxable property within the county fairly and uniformly. They consider various factors, including market sales data, property characteristics, and improvements, to arrive at an appraised value. This value forms the basis upon which your taxes are levied. Once the appraised value is established, it is then multiplied by the tax rates set by each individual taxing unit. Each unit, such as the county, school district, city, or special district, determines its own tax rate based on its budgetary needs. For example, a property might be subject to the Fort Bend County tax rate, the Fort Bend Independent School District (ISD) tax rate, a Municipal Utility District (MUD) rate, and potentially other special district rates. The sum of these individual tax liabilities constitutes your total Fort Bend property taxes. For instance, based on the provided data, **Fort Bend ISD 1 S07 has a total tax rate of $0.989200 per $100 valuation, broken down into $0.719200 for Maintenance & Operations (M/O) and $0.270000 for Interest & Sinking (I/S).** Similarly, a district like **Bend MUD 46 120 M96** would have its own specific rate contributing to the overall tax bill. Understanding these individual rates is key to comprehending your total tax obligation.Decoding Your Fort Bend Property Tax Statement

When your annual Fort Bend property tax statement arrives, it can seem like a dense document filled with numbers and acronyms. However, understanding its components is vital for every homeowner. The statement provides a detailed breakdown of your property's appraised value, any applicable exemptions, and the tax rates imposed by each taxing entity. It typically lists the market value and the taxable value (which is the market value minus any exemptions). You'll then see a list of individual taxing units that apply to your property, such as Fort Bend County, your specific Independent School District (e.g., Fort Bend ISD), your city (if applicable), and any special districts like MUDs, ESDs, or PIDs. For each taxing unit, the statement will show its specific tax rate per $100 of taxable value, and the calculated tax amount for that unit. For example, you might see a line item for "Fort Bend ISD" with its rate and the corresponding tax amount. It's crucial to review each line item carefully to ensure accuracy and to understand exactly which entities are taxing your property. This statement also typically includes information on the payment deadline, any discounts for early payment, and penalties for late payment. Taking the time to thoroughly review and understand your tax statement is an essential step in managing your Fort Bend property taxes effectively.Navigating the Fort Bend County Tax Office Resources

The Fort Bend County Tax Assessor-Collector's Office is more than just a collection agency; it's a vital resource for taxpayers seeking information and assistance with their Fort Bend property taxes. Recognizing the complexities involved, the office provides multiple avenues for residents to access information, ask questions, and fulfill their tax obligations. Leveraging these resources can significantly simplify the process of understanding and managing your property taxes, ensuring you stay informed and compliant. Whether you prefer digital access or direct communication, the county has established channels to support taxpayers.Online Resources for Fort Bend Property Taxes

In today's digital age, online access to property tax information is a cornerstone of transparency and convenience. The Fort Bend County Tax Assessor-Collector's Office provides robust online tools designed to empower property owners. A crucial starting point is the state's official portal: **visit texas.gov/propertytaxes to find a link to your local property tax database where you can easily access information regarding your property taxes, including the details of your specific property.** This database allows you to search for your property, view its appraised value, check the tax rates applied by various entities, and see your current tax bill. Beyond the general state portal, the Fort Bend County Tax Assessor-Collector's own website typically features a dedicated "Property Tax Estimator" or "Property Search" tool. This allows you to **search for a property** by address or account number to obtain detailed tax information, including historical data, payment status, and a breakdown of the taxing units. These online tools are invaluable for conducting research, verifying information, and staying up-to-date on your Fort Bend property taxes from the comfort of your home.In-Person and Contact Options

While online resources offer immense convenience, sometimes a direct conversation is necessary. The Fort Bend County Tax Assessor-Collector's Office understands this need and provides various ways for taxpayers to get personalized assistance. **Our staff is on hand to answer your auto and property tax questions**, offering expert guidance on everything from understanding your tax statement to applying for exemptions. This direct line of communication is invaluable for resolving complex issues or clarifying specific details about your Fort Bend property taxes. For those who prefer digital communication, the office actively monitors its email channels. **Contact the tax office via email**, and rest assured that **we are monitoring the tax office email account throughout the day** to provide timely responses. This ensures that even if you can't make it to an office location or prefer written correspondence, your inquiries will be addressed promptly. Of course, traditional methods remain available: **contact the tax office via phone or email** for any questions or assistance you may need. The multiple contact options reflect a commitment to comprehensive taxpayer support.Key Entities Influencing Fort Bend Property Taxes

Your total Fort Bend property taxes are not levied by a single entity but rather by a combination of various local governmental units, each with its own budget and tax rate. Understanding these distinct entities is fundamental to comprehending how your overall tax bill is calculated and where your tax dollars are allocated. These entities include: * **Fort Bend County:** This is the overarching county government that levies taxes to fund county-wide services such as law enforcement, courts, health services, and county roads. * **Independent School Districts (ISDs):** The largest portion of most property tax bills goes to school districts. Fort Bend County is served by several ISDs, including the prominent **Fort Bend ISD**. As noted, **Fort Bend ISD 1 S07 has a total tax rate of $0.989200 per $100 valuation**, with components for Maintenance & Operations (M/O) and Interest & Sinking (I/S) funds, which cover day-to-day operations and debt service for facilities, respectively. * **Cities:** If your property is located within an incorporated city (e.g., Sugar Land, Katy, Richmond, Rosenberg), that city will also levy a property tax to fund municipal services like police, fire, parks, and city infrastructure. * **Municipal Utility Districts (MUDs):** Many properties, especially in newer developments, are located within MUDs. These special districts are created to provide water, sewer, drainage, and sometimes road infrastructure to areas where these services were not previously available. They levy taxes to repay the bonds issued for these improvements and to cover operational costs. An example is **Bend MUD 46 120 M96**, which would have its own specific tax rate. * **Emergency Services Districts (ESDs):** These districts provide fire protection and emergency medical services. **Fort Bend ESD #10** is an example of such a district that levies taxes to support these critical services. * **Public Improvement Districts (PIDs) & Levee Improvement Districts (LIDs):** These are specific districts created to fund improvements within a defined area. **The Park at Eldridge PID** and **Fort Bend County LID #2** are examples where property owners within these boundaries pay additional taxes for specific enhancements or flood control measures. Each of these "tax units" has an "act code" and contributes to the "total tax rate" on your property, as reflected in the "Tax unit act code cad total tax rate m/o i/s ot exemptions" breakdown you might see on official documents. The cumulative effect of these individual rates determines your complete Fort Bend property taxes.Exemptions and Relief Programs for Fort Bend Property Taxes

One of the most effective ways to manage your Fort Bend property taxes is by ensuring you are taking advantage of all eligible exemptions. Exemptions reduce the taxable value of your property, thereby lowering your tax bill. The most common and significant exemption for homeowners is the homestead exemption. If your home is your primary residence, you are likely eligible for a general homestead exemption. This exemption removes a portion of your home's value from taxation by the school district, and potentially by other taxing units as well. For example, in Texas, the state mandates a significant homestead exemption for school district taxes, which can dramatically reduce the taxable value. The data provided mentions a **homestead exemption of $100,000**, which is a substantial reduction for school district purposes. Beyond the general homestead exemption, other significant exemptions include: * **Over-65 Exemption:** Homeowners aged 65 or older are eligible for an additional homestead exemption from school districts and may also qualify for a tax ceiling on their school taxes, meaning the amount of school tax cannot increase as long as they own and reside in that home. * **Disabled Person Exemption:** Similar to the over-65 exemption, homeowners with a qualifying disability can receive an additional exemption and potentially a tax ceiling from school districts. * **Disabled Veteran Exemption:** Veterans with a service-connected disability are eligible for an exemption based on their disability rating, which can range from a few thousand dollars to a 100% exemption for 100% disabled veterans. * **Surviving Spouse Exemptions:** Spouses of deceased veterans or those who qualified for over-65 or disabled person exemptions may also be eligible for continued relief. It is crucial to apply for these exemptions with the Fort Bend Central Appraisal District. They are not automatically applied. Missing out on eligible exemptions can lead to paying significantly more in Fort Bend property taxes than you legally owe. The application process is typically straightforward and requires submitting the necessary forms and supporting documentation.Understanding Delinquent Fort Bend Property Taxes and Tax Certificates

Paying your Fort Bend property taxes on time is paramount. Taxes are typically due by January 31st of the year following the tax year (e.g., 2023 taxes are due by January 31, 2024). If taxes are not paid by this deadline, they become delinquent, incurring penalties and interest charges that can quickly accumulate. The longer taxes remain unpaid, the higher the penalties and interest, making it increasingly difficult to settle the debt. The Fort Bend County Tax Assessor-Collector's Office is legally obligated to pursue collection of delinquent taxes, which can eventually lead to legal action, including foreclosure and sale of the property. A significant aspect of delinquent taxes in Texas is the concept of a tax certificate. You might ask, **"What is a tax certificate and how can I obtain one?" A tax certificate is a certified document showing the amount of delinquent taxes, penalties, and interest due the unit on a property.** These certificates are typically issued by the tax office to provide an official record of the outstanding tax liability. They are crucial for various reasons: * **For Property Owners:** If you are selling a property with delinquent taxes, a tax certificate provides the exact amount needed to clear the debt before closing. * **For Buyers/Investors:** When purchasing property, especially at tax sales or through other non-traditional means, a tax certificate confirms any outstanding tax liens. This is vital for due diligence, as unpaid property taxes in Texas constitute a first lien on the property, taking precedence over most other liens, including mortgages. * **For Title Companies:** Title companies rely on tax certificates to ensure that all property taxes are paid up to date before a property transfer is finalized, protecting the buyer from inheriting delinquent tax liabilities. Understanding the implications of delinquent Fort Bend property taxes and the role of tax certificates is essential for both current property owners and prospective buyers to avoid unforeseen financial complications.Tips for Managing Your Fort Bend Property Tax Burden

While property taxes are an unavoidable part of homeownership, there are proactive steps you can take to manage your Fort Bend property taxes and potentially reduce your annual bill. Being informed and diligent can make a significant difference in your financial planning. 1. **Protest Your Appraisal:** If you believe the Fort Bend Central Appraisal District has appraised your property for more than its market value, you have the right to protest the appraisal. This process typically involves submitting evidence that your home is valued higher than comparable properties in your area, or that the CAD's assessment contains errors. The deadline for protesting is usually May 15th or 30 days after the appraisal notice is mailed, whichever is later. A successful protest can lower your taxable value and, consequently, your tax bill. 2. **Apply for All Eligible Exemptions:** As discussed, homestead, over-65, disabled person, and disabled veteran exemptions can significantly reduce your taxable value. Make sure you apply for every exemption you qualify for with the Fort Bend Central Appraisal District. This is often the easiest and most impactful way to lower your Fort Bend property taxes. 3. **Budget for Taxes:** Don't let your property tax bill catch you off guard. Factor your estimated property taxes into your monthly budget. If you have an escrow account with your mortgage lender, they will typically handle this for you. If not, consider setting aside funds each month to avoid a large lump sum payment at the end of the year. 4. **Stay Informed About Tax Law Changes:** Property tax laws and rates can change. Keep an eye on local news, official county announcements, and updates from the Fort Bend County Tax Assessor-Collector's Office. Staying informed ensures you are aware of any new exemptions, rate changes, or deadlines that could affect your Fort Bend property taxes. 5. **Utilize Tax Office Resources:** Don't hesitate to reach out to the Fort Bend County Tax Assessor-Collector's Office if you have questions. Their staff is equipped to provide accurate information and guide you through various processes, as highlighted by the accessibility of their staff via phone, email, and in-person visits. By actively engaging with these strategies, you can gain better control over your Fort Bend property taxes and ensure you are paying only what is legally required.The Future of Fort Bend Property Taxes

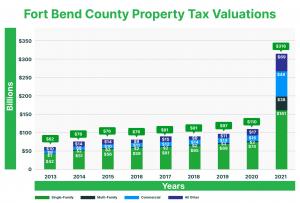

The landscape of Fort Bend property taxes is dynamic, influenced by a multitude of factors that shape the economic and demographic growth of the county. As one of the fastest-growing counties in the nation, Fort Bend experiences continuous development, increasing property values, and evolving demands for public services. These trends inevitably impact property tax rates and collections. Factors such as population growth necessitate expanded infrastructure, more schools, and increased public safety resources, which are primarily funded through property taxes. Furthermore, state legislative changes can also significantly influence local property tax structures. Texas periodically enacts reforms aimed at property tax relief or adjustments to appraisal methodologies. Staying abreast of these potential changes is crucial for homeowners, as they can directly affect future tax bills. The ongoing balance between funding essential services and providing tax relief to residents will continue to be a key discussion point for local and state policymakers. For Fort Bend residents, remaining engaged with local government decisions and understanding the broader economic climate will be essential for anticipating and adapting to future changes in Fort Bend property taxes.Conclusion

Navigating the world of Fort Bend property taxes doesn't have to be an overwhelming ordeal. By understanding the basics of how taxes are assessed, familiarizing yourself with the various taxing entities, and actively utilizing the extensive resources provided by the Fort Bend County Tax Assessor-Collector's Office, you can confidently manage your property tax obligations. Remember, your property taxes are a vital contribution to the quality of life and robust services that make Fort Bend County such a desirable place to live. We hope this comprehensive guide has provided you with valuable insights and clarified many aspects of Fort Bend property taxes. Do you have specific questions about your tax bill, or perhaps a tip for fellow Fort Bend homeowners? Share your thoughts and experiences in the comments below! If you found this article helpful, please consider sharing it with others who might benefit from a clearer understanding of their property tax responsibilities in Fort Bend County. For more essential guides on homeownership and local financial matters, explore other articles on our site.

Fort Bend County Property Tax Trends | O'Connor

Fort Bend County Property Tax Trends - EIN Presswire

Fort Bend Property Tax Trends | Property Tax