Who Owns General Motors? Unraveling The Ownership Mystery

Have you ever wondered who truly holds the reins of one of the world's largest and most iconic automotive companies, General Motors? For many, the question of "who owns General Motors" might seem straightforward, perhaps envisioning a single, powerful individual or family at the helm. However, the reality is far more intricate and dynamic, reflecting the complex nature of modern corporate ownership.

In an era where corporate giants shape our daily lives, understanding their ownership structures is crucial, especially for a company like General Motors, which impacts global economies, employment, and innovation. Gone are the days when ownership was easily pinpointed; as one might observe, "It used to be General Motors, now it is anyone's guess!" This article delves deep into the multifaceted ownership landscape of General Motors, exploring the layers of shareholders, the historical shifts, and the implications of its publicly traded status.

Table of Contents

- The Evolution of General Motors Ownership

- Understanding Publicly Traded Corporations

- Major Shareholders: Who Holds the Reins of General Motors?

- The Role of Institutional Investors in General Motors

- General Motors and Government Intervention: A Historical Look

- Disentangling Ownership: General Motors vs. Other Auto Giants

- The Impact of Ownership Structure on General Motors' Strategy

- Beyond the Balance Sheet: The Future of General Motors Ownership

The Evolution of General Motors Ownership

General Motors, often simply referred to as GM, was founded in 1908 by William C. Durant. From its inception, GM grew rapidly, acquiring numerous smaller automobile companies and quickly becoming a dominant force in the burgeoning automotive industry. For much of its early history, GM operated as a conventional corporation, with ownership initially concentrated among a few key individuals and early investors. However, as the company expanded and sought more capital for growth, it transitioned into a publicly traded entity, making its shares available for purchase by the general public on stock exchanges. This fundamental shift meant that ownership became distributed among a vast number of shareholders, rather than residing with a select few. The most significant inflection point in GM's ownership history occurred during the 2008-2009 financial crisis. Facing imminent collapse, General Motors received a massive government bailout from the U.S. Treasury, which effectively made the U.S. government its largest shareholder for a period. This unprecedented intervention temporarily altered the answer to "who owns General Motors" from a purely market-driven one to a hybrid of public and governmental ownership. The government's stake was not intended to be permanent, and over the subsequent years, General Motors disinvested the last of their interest in the company, selling off its shares back into the open market. This divestment marked a return to a fully publicly traded model, albeit one shaped by the lessons and restructuring that followed the crisis. Understanding this journey is key to grasping the current, complex answer to who owns GM today.Understanding Publicly Traded Corporations

To truly comprehend who owns General Motors, it's essential to grasp the concept of a publicly traded corporation. Unlike a privately held company, which is owned by a small group of individuals, families, or private equity firms, a publicly traded corporation has its shares listed on a stock exchange, making them available for purchase by anyone. This means that ownership is fractionalized and distributed among millions of investors worldwide. Each share of stock represents a tiny sliver of ownership in the company. When you buy a share of General Motors stock, you become a part-owner, albeit a very small one. This widespread distribution of ownership means that no single individual or entity typically "owns" the entire company in the traditional sense. Instead, ownership is dispersed among a vast pool of shareholders, ranging from individual retail investors to massive institutional investment funds. The collective decisions and actions of these shareholders, primarily through their buying and selling of shares, determine the company's market valuation and influence its strategic direction. The board of directors and management team are ultimately accountable to these shareholders, whose primary goal is often to see the value of their investment grow. This model ensures transparency and liquidity, but also means that the question of "who owns General Motors" is never a simple one-word answer.Major Shareholders: Who Holds the Reins of General Motors?

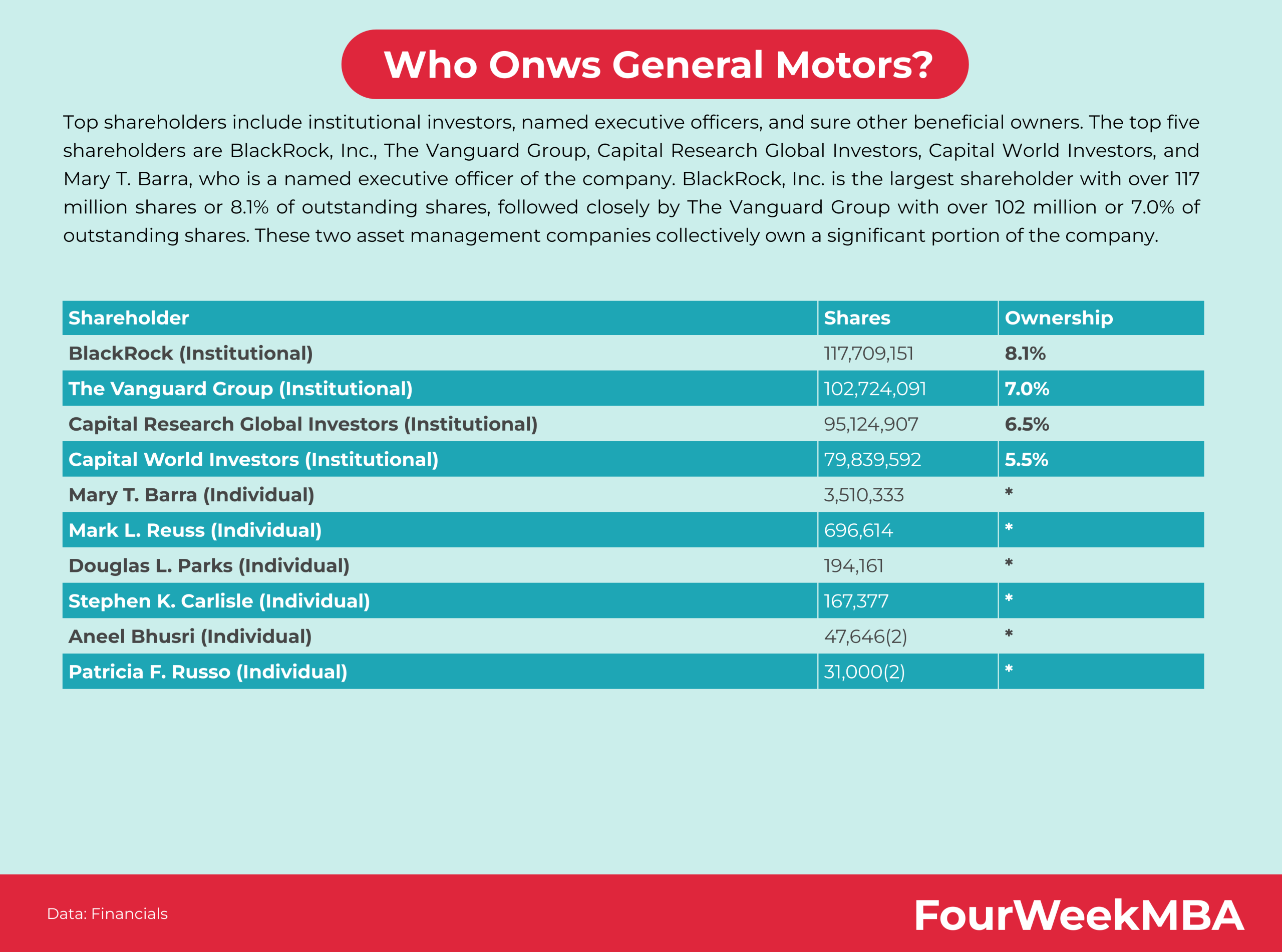

While no single entity can claim outright ownership of General Motors, certain major shareholders hold significant influence due to the sheer volume of shares they control. These are primarily large institutional investors that manage vast sums of money on behalf of their clients. Think of investment management firms, mutual funds, pension funds, and hedge funds. These entities acquire substantial blocks of GM stock, making them the most significant players in the ownership structure. They don't run the day-to-day operations, but their collective holdings give them considerable sway over major corporate decisions, including the election of board members and approval of significant strategic moves.The Power of the Proxy Vote

One of the primary ways these major shareholders exert their influence is through proxy voting. As owners of a large percentage of General Motors' outstanding shares, institutional investors have voting rights proportionate to their holdings. They vote on critical matters such as the election of the board of directors, executive compensation packages, and major corporate policies. While individual retail investors also have these voting rights, their collective impact is often dwarfed by the consolidated power of institutional investors. These large firms often have dedicated teams that analyze corporate governance issues and make informed decisions on how to cast their votes, effectively shaping the future direction of General Motors. Their investment in GM is not just about financial returns but also about influencing the company's long-term sustainability and ethical practices.Individual Investors: A Collective Force

Beyond the institutional giants, millions of individual investors also own shares of General Motors. These are everyday people who might have bought GM stock through their brokerage accounts, retirement funds, or employee stock purchase plans. While each individual's holding is typically small compared to an institutional fund, their collective ownership represents a significant portion of the company. These "retail investors" contribute to the liquidity of the stock market and reflect broader public sentiment towards the company. Although they may not wield the same direct influence as large institutions in proxy votes, their aggregate buying and selling activity can significantly impact GM's stock price and market capitalization. Thus, when asking "who owns General Motors," it's crucial to remember that it's a vast, diverse group of both professional money managers and everyday citizens.The Role of Institutional Investors in General Motors

Institutional investors are the backbone of ownership for most large publicly traded companies, and General Motors is no exception. Firms like Vanguard, BlackRock, and State Street Global Advisors, which manage trillions of dollars in assets, consistently appear among the top shareholders of GM. These firms often invest in GM through various index funds, exchange-traded funds (ETFs), and actively managed portfolios. For instance, if you own shares in a broad market index fund, it's highly likely that you indirectly own a tiny fraction of General Motors through that fund. Their investment in GM is driven by a combination of factors: the company's market capitalization, its inclusion in major stock indices, its dividend policy, and its long-term growth prospects. These institutional investors typically adopt a long-term investment horizon, meaning they are less concerned with short-term stock fluctuations and more focused on the company's fundamental performance and strategic direction over years. Their substantial holdings provide stability to GM's stock and signify a vote of confidence in its management and future. Furthermore, their sheer size means they can engage directly with GM's management and board, advocating for specific corporate governance practices, environmental policies, or strategic shifts that they believe will enhance long-term shareholder value. The presence of these powerful institutional players underscores the complex and distributed nature of who owns General Motors today.General Motors and Government Intervention: A Historical Look

The question of "who owns General Motors" took a dramatic turn during the global financial crisis of 2008-2009. Faced with an unprecedented economic downturn and years of accumulated challenges, General Motors teetered on the brink of collapse. To prevent the devastating ripple effects of such a failure on the U.S. economy and its vast workforce, the U.S. government, under the Bush and then Obama administrations, intervened with a massive bailout package. This intervention included significant financial aid in exchange for a substantial equity stake in the company. At its peak, the U.S. Treasury became the largest single shareholder of General Motors, holding approximately 60.8% of the company's common stock. This period was unique, as it meant that, for a time, the American taxpayers, through their government, effectively owned the majority of General Motors. This move, while controversial, was deemed necessary to stabilize the auto industry and preserve millions of jobs. However, the government's role was always intended to be temporary. As the company restructured, streamlined operations, and returned to profitability, the U.S. Treasury began divesting its shares. This process was completed in December 2013, when General Motors disinvested the last of their interest in the company, selling its remaining stake. This marked GM's full return to private ownership by public shareholders, closing a significant chapter in its ownership history and reaffirming its status as a publicly traded entity owned by a multitude of investors.Disentangling Ownership: General Motors vs. Other Auto Giants

When discussing "who owns General Motors," it's helpful to compare its ownership structure to that of other major players in the automotive industry. Not all car companies are owned in the same way, illustrating the diverse models of corporate ownership that exist globally.The Case of Ford Motors

Ford Motors is a publicly traded corporation with a great many stock, much like General Motors. Both companies are listed on major stock exchanges, and their shares are widely available to institutional and individual investors. However, a key difference lies in Ford's unique dual-class share structure. While the majority of Ford's shares are publicly traded, the Ford family retains significant control through special Class B shares that carry disproportionate voting rights. This means that while the public owns the economic interest, the Ford family maintains a strong influence over the company's strategic direction and governance, a level of direct family control not seen in General Motors' current structure.Isuzu and Subaru: A Different Ownership Landscape

Looking eastward, the ownership models of Japanese automakers often present a different picture. For example, Isuzu Motors Ltd is owned by Mitsubishi Corporation, Itochu, and Toyota, all of Japan. This demonstrates a more concentrated form of corporate ownership, where major corporations hold significant stakes in other companies, often as part of strategic alliances or keiretsu (a set of companies with interlocking business relationships and shareholdings). Similarly, as for who owns Subaru as a whole, that would be Fuji Heavy Industries (now Subaru Corporation), which historically had a strong relationship with Nissan and later Toyota. While Subaru Corporation itself is publicly traded, its ownership has been influenced by strategic partnerships and major corporate shareholders. Another interesting example is "What car company owns Jaguar?" The answer is Tata Motors, an Indian multinational automotive manufacturer. This highlights how global mergers and acquisitions can lead to a car brand being owned by a company from a completely different region, a common occurrence in the interconnected global economy. These examples underscore that while "who owns General Motors" points to a widely dispersed public ownership, the automotive world features a spectrum of ownership structures, from family-controlled public companies to corporate alliances and foreign acquisitions.The Impact of Ownership Structure on General Motors' Strategy

The fact that "who owns General Motors" is a complex web of millions of shareholders, predominantly institutional investors, profoundly impacts the company's strategic decision-making. As a publicly traded entity, GM is under constant scrutiny from the financial markets. This means its management team and board of directors are primarily accountable to shareholders, whose overarching goal is to maximize shareholder value. This accountability translates into several key strategic imperatives for General Motors: * **Focus on Profitability and Growth:** Decisions are often geared towards improving financial performance, increasing market share, and driving innovation that can lead to higher revenues and profits, which in turn can boost the stock price. * **Transparency and Reporting:** Public companies are required to disclose extensive financial and operational information to the public and regulatory bodies (like the SEC in the U.S.). This transparency allows shareholders to monitor performance and hold management accountable. * **Corporate Governance:** Strong corporate governance practices are crucial to ensure that the company is run ethically and in the best interests of its shareholders. This includes independent board members, robust audit committees, and clear executive compensation structures. * **Long-Term vs. Short-Term Pressures:** While institutional investors often have a long-term view, the quarterly earnings cycle can create pressure for short-term results. GM's management must balance these demands, investing in future technologies like electric vehicles and autonomous driving while delivering consistent performance in the present. In essence, the distributed ownership model of General Motors means that its strategy is a delicate balance of innovation, financial discipline, and responsiveness to the collective expectations of its diverse shareholder base. Every major investment, product launch, or strategic pivot is ultimately aimed at creating value for those who own a piece of General Motors.Beyond the Balance Sheet: The Future of General Motors Ownership

As the automotive industry undergoes a transformative shift towards electrification, connectivity, and autonomous driving, the question of "who owns General Motors" remains pertinent to its future trajectory. While the core structure of diffuse public ownership is likely to persist, several trends could subtly influence the composition and priorities of GM's shareholder base. The rise of Environmental, Social, and Governance (ESG) investing, for instance, means that a growing number of institutional investors are integrating sustainability and ethical considerations into their investment decisions. This could lead to a shareholder base that increasingly pressures General Motors to accelerate its transition to electric vehicles, improve supply chain ethics, and enhance diversity within its workforce. Activist investors, though not owning the majority, could also emerge, taking significant stakes to push for specific strategic changes or operational improvements. Furthermore, the continued consolidation within the asset management industry could mean that an even smaller number of institutional giants hold increasingly larger blocks of GM shares, potentially amplifying their influence. Ultimately, the answer to "who owns General Motors" will continue to be a dynamic one, reflecting the ebb and flow of capital markets, the evolving priorities of global investors, and the company's own strategic responses to a rapidly changing world. It is a testament to the modern corporate structure that a company of GM's immense scale is not controlled by a single individual or family, but rather by a vast, interconnected network of investors, each holding a piece of its future.Conclusion

In conclusion, the question of "who owns General Motors" is far from a simple query. It reveals a complex tapestry of ownership characteristic of most major global corporations today. While General Motors was once subject to significant government ownership during a critical period, it has long since returned to being a fully publicly traded company. This means that its ownership is highly fragmented, distributed among millions of individual and institutional investors worldwide. No single entity "owns" General Motors; instead, it is collectively owned by its shareholders, with large institutional investors like Vanguard, BlackRock, and State Street holding the most significant blocks of shares. Their influence, wielded through proxy votes and direct engagement, plays a crucial role in shaping GM's strategic direction, ensuring accountability, and driving value creation. This distributed ownership model, while complex, underscores GM's transparency and its commitment to a broad base of stakeholders. Understanding this intricate structure is vital for anyone interested in the future of one of America's most enduring industrial giants. We hope this deep dive has shed light on the fascinating world of corporate ownership. What are your thoughts on the distributed ownership model of companies like General Motors? Do you think it makes them more accountable or less agile? Share your insights in the comments below! If you found this article informative, consider sharing it with others who might be curious about the inner workings of major corporations, or explore other articles on our site about corporate structures and financial markets.

Who Owns GM: The Ins and Outs of General Motors' Ownership - GM Global

Who Owns GM: The Ins and Outs of General Motors' Ownership - GM Global

Who Owns General Motors? - FourWeekMBA