Unlocking Chase Mortgage Rates Today: Your Guide To Home Financing

Navigating Today's Mortgage Landscape with Chase

In today's dynamic housing market, understanding mortgage interest rates is paramount for anyone looking to buy a home or refinance an existing one. Specifically, delving into Chase mortgage interest rates today offers a crucial starting point for many prospective homeowners. With rates constantly fluctuating, staying informed about what a major lender like Chase offers can significantly impact your financial planning and long-term investment. This comprehensive guide aims to demystify the process, providing clear insights into Chase's current offerings and helping you make well-informed decisions.

Whether you're a first-time homebuyer, looking to upgrade, or considering refinancing to lower your monthly payments, the interest rate you secure will be a cornerstone of your financial commitment. Chase, as one of the largest financial institutions, plays a significant role in the mortgage market, providing a wide array of products designed to meet diverse needs. This article will equip you with the knowledge to confidently explore your options, ensuring you're prepared to check the most current and competitive mortgage rates when choosing a home loan with Chase Mortgage.

Understanding Chase Mortgage Interest Rates Today

The mortgage market is a living entity, constantly responding to economic indicators, Federal Reserve policies, and global events. For those interested in home financing, keeping an eye on these movements is key. Recently, there's been encouraging news for borrowers: mortgage rates are down and under 7%, a welcome shift from previous highs. This positive trend makes it an opportune time to explore what Chase has to offer, as competitive rates can lead to substantial savings over the life of your loan.

A Current Snapshot of Chase Rates

When you're ready to make a move, getting the "low down" on today's mortgage products from Chase Bank, as well as updated rates, lender fees, and states served, is essential. Based on recent insights, Chase mortgage rates today offer competitive options for various loan terms and purposes. For instance, you might find that:

- 15-Year Fixed-Rate Mortgage: Rates can be around 5.91%. This option is popular for those who want to pay off their home faster and typically comes with a lower interest rate compared to longer terms. A 15-year mortgage often means higher monthly payments, but the total interest paid over the loan's lifetime is significantly reduced. This makes it an attractive choice for borrowers with stable, higher incomes who prioritize accelerated debt repayment.

- 30-Year Refinance Mortgage: Rates might be around 6.35%. If you're looking to refinance, this longer term can offer lower monthly payments, making your budget more manageable. The 30-year option is a common choice for its affordability and flexibility, allowing borrowers to spread out their payments over a longer period. While the total interest paid will be higher than a 15-year loan, the lower monthly burden can be a crucial factor for many households.

It's crucial to remember that these rates are illustrative and can change rapidly. Your actual rate will depend on various factors, including your credit score, down payment, loan-to-value (LTV) ratio, and specific loan program. Lenders assess your financial risk, and a higher credit score, for example, typically translates to a lower interest rate because you are deemed a more reliable borrower. Therefore, it's always recommended to check the most current and competitive mortgage rates directly with Chase, as they can provide a personalized quote based on your unique financial profile.

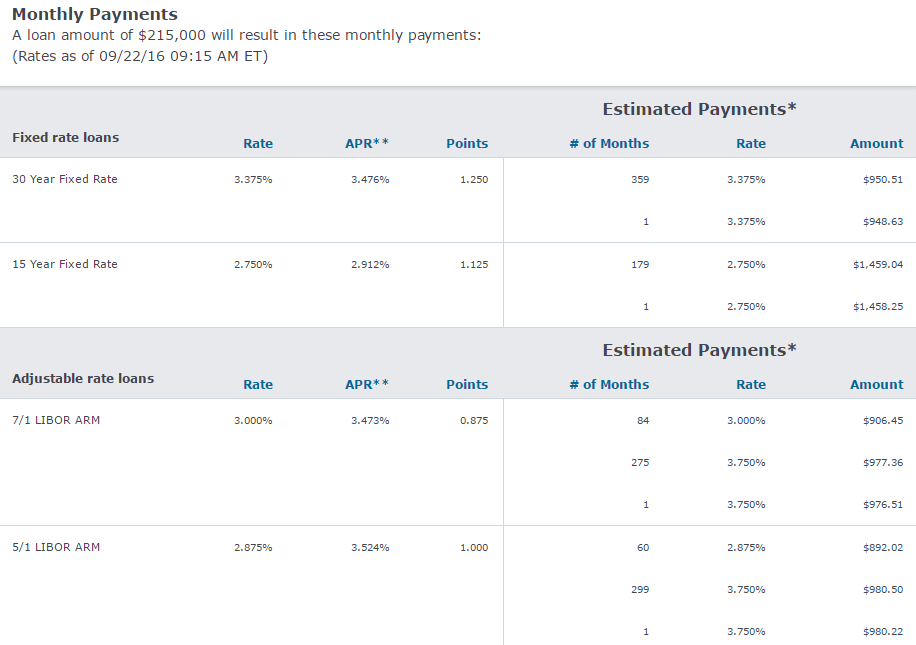

Monthly Payment Insights: What to Expect

Understanding the interest rate is one thing, but knowing what that translates to in terms of monthly payments is where the rubber meets the road. Let's consider a practical example to illustrate the impact of Chase mortgage interest rates today on your budget. For a $500,000 15-year mortgage, the monthly payment could be approximately $4,195.01. This figure includes principal and interest but excludes property taxes, homeowner's insurance, and any potential HOA fees, which would add to your total monthly housing cost.

This example highlights the significant financial commitment involved. It underscores the importance of not just looking at the interest rate in isolation, but also using tools like a mortgage calculator to view today’s mortgage rates or calculate what you can afford. A robust mortgage calculator allows you to input different scenarios – varying loan amounts, interest rates, and terms – to see how each factor influences your monthly payment. This comprehensive approach ensures you're comfortable with the monthly obligation before committing to a loan, preventing future financial strain. Remember, your comfort level with the payment is just as important as securing a competitive rate.

Exploring Chase Mortgage Products and Services

Chase offers a diverse portfolio of mortgage products designed to cater to different financial situations and homeownership goals. Beyond just the interest rates, understanding the various loan types available is key to choosing the best option. Their offerings typically include:

- Fixed-Rate Mortgages: These loans offer a consistent interest rate for the entire loan term, providing predictability in your monthly payments. They are ideal for borrowers who prefer stability and are comfortable with the current market rates, as your principal and interest payment will remain the same for the life of the loan, regardless of market fluctuations.

- Adjustable-Rate Mortgages (ARMs): ARMs start with a lower interest rate for an initial period (e.g., 5, 7, or 10 years), after which the rate adjusts periodically based on market indexes. These can be attractive for those who plan to sell or refinance before the adjustment period, or for those who anticipate future income growth. While they offer lower initial payments, borrowers should be aware of the potential for rate increases in the future.

- FHA Loans: Backed by the Federal Housing Administration, FHA loans are popular for first-time homebuyers due to their lower down payment requirements (as low as 3.5%) and more flexible credit guidelines. They are designed to make homeownership more accessible, especially for those with less-than-perfect credit or limited savings for a down payment.

- VA Loans: Exclusively for eligible service members, veterans, and surviving spouses, VA loans offer significant benefits, including no down payment requirement, no private mortgage insurance (PMI), and competitive interest rates. These loans are a well-deserved benefit for those who have served our country.

- Jumbo Loans: For borrowers seeking to finance homes above the conforming loan limits set by government-sponsored enterprises (Fannie Mae and Freddie Mac), Chase provides jumbo loans, often for high-value properties in competitive markets. These loans have stricter qualification requirements due to their larger size.

When you compare current mortgage rates across a variety of mortgage products from Chase, it's not just about the percentage. It's about finding the product that aligns with your financial strategy, risk tolerance, and long-term housing plans. Each product has its own set of eligibility criteria, benefits, and potential drawbacks, making a thorough review essential. Engaging with a Chase mortgage professional can help you navigate these options and identify the best fit for your unique circumstances.

Comparing Chase Mortgage Rates: Beyond the Numbers

While the specific Chase mortgage interest rates today are a primary concern, a truly informed decision involves more than just glancing at a number. It requires a holistic comparison, considering various factors that influence the overall cost of your loan and your financial comfort. The advertised rates are merely a starting point; your personal financial situation will dictate the actual rate you receive.

Finding Your Personalized Rate

The rates you see advertised are often "best case" scenarios for highly qualified borrowers. To get a precise understanding of what you qualify for, you need to compare personalized mortgage and refinance rates today. While Chase provides competitive options, it's also wise to look across a national marketplace of lenders to find the best current rate for your financial situation. This process involves a soft credit pull (which doesn't impact your score) and providing details about your income, assets, and desired loan amount. Personalized quotes will reflect your unique financial profile, giving you a much clearer picture of your potential monthly payments and total interest paid over the loan term. This step is critical because even a small difference in the interest rate can amount to thousands of dollars in savings over the life of a 30-year mortgage.

When you're ready to move forward, remember to check the most current and competitive mortgage rates directly with Chase. Their online tools and mortgage specialists can provide personalized quotes that accurately reflect your eligibility, taking into account factors like your credit history, debt-to-income ratio, and down payment amount. Don't rely solely on advertised rates; always seek a personalized quote.

Understanding Lender Fees and State Service

Beyond the interest rate, lender fees can significantly impact the total cost of your mortgage. These can include origination fees, application fees, underwriting fees, and discount points (which you pay to lower your interest rate). When getting the low down on today's mortgage products from Chase Bank, inquire about all associated lender fees. Transparency in this area is crucial for an accurate comparison. A lower interest rate might seem appealing, but if it comes with exorbitant upfront fees, the overall cost of the loan could be higher. Always ask for a Loan Estimate, which details all the costs associated with your mortgage.

Additionally, it's important to confirm that Chase serves your specific state. While Chase has a broad national presence, the availability of certain products or services might vary by location due to state-specific regulations or market conditions. This information is typically readily available on their website or by speaking with a mortgage professional. Before investing time in the application process, a quick check on state availability can save you considerable effort. Understanding these details upfront ensures a smoother and more predictable mortgage journey.

Considering Refinancing with Chase Mortgage

Fixed Mortgage Rates: Chase 30 Year Fixed Mortgage Rates

Cd interest rates chase - upfspec

33+ chase refinancing mortgage rates - CarralNyree